Marketing Strategy For Software Development Companies

Research Report | November 2021

IT Industry Outlook 2022

Introduction

S uffice to say, the prediction business has been a tough one over the last two years. Unpredictability and uncertainty have ruled, leaving many companies and their workers on unsure footing. As a result, many firms sidelined their broader strategic initiatives and goals as a way to stay afloat. They remained in tactical mode to ensure certain basic outcomes: Keep the lights on, pay your people, hold onto your customers, and, at minimum, maintain status quo revenue intake. Bide your time, in other words.

But history tells us that you can't stay in bunker mode forever. At some point, you must climb out. Encouragingly, signs point upward and onward as we head into 2022, with a level of cautious optimism creeping back into the technology industry. The attitude lift is happening at both the IT professional level and among those in the business of technology – channel firms, vendors, distributors and the like. Tech budgets are expected to increase in 2022, some to the heftier pre-pandemic levels of 2019 or beyond. That means expanded opportunities to hire and fill in the missing skills that have held firms back from any number of ambitious pursuits.

Along those lines, companies are beginning once again to talk up their plans to continue with or dive into emerging technologies or to fast-track digital transformation projects. On the channel side, firms are embracing the pivot to new business models to ensure both continued industry relevance, competitive differentiation and innovation in the years ahead.

There's no doubt some firms took a hit in the last couple of years, and we can't discount still-looming concerns related to the global economy, the pandemic and the state of public affairs. And yet, 2022 is shaping up to be a year of not just recovery, but of acceleration and innovation. The new year brings us a return to strategy.

Trends to Watch 2022

Who? What? Where? How? Companies all over have been facing these questions about their workforce operations in the midst—and hopefully soon the wake—of the COVID pandemic. Bottom line: the definition of a workplace has changed, and likely for good. The swift move from traditional office-based work to full-time at-home work has exposed upsides and downsides that companies will need to balance in the year ahead. The considerations employers and employees will be making in 2022 and beyond span a range of topics from the psychological to the technological. In the case of the former, workplace studies over the last 18 months have shown that employees today, many having now worked remotely for an extended period, are demanding different requirements from their employers in how they approach post-pandemic "normalcy." They may want to remain 100% remote, operate in a hybrid mode of remote and in-office, or craft another flexible arrangement that capitalizes on the fact that technology enables many of them to work from anywhere. From a technology perspective, remote work has placed new priorities on IT departments accustomed to managing a main headquarters and some satellite branches vs. a spider's web of residential homes. And many firms that created stand-up solutions to accommodate the impact of the pandemic are now making them permanent for their workers. On a positive note, channel firms found renewed opportunity in selling hardware and edge-based security during the work-from-home migration, while managed services providers were called in to help oversee the plethora of residential-based nodes on networks. The pandemic also pushed many companies to jumpstart or accelerate their digital transformation efforts. A McKinsey Global Survey of executives found that companies have sped the digitization of their customer relations, supply chains and internal operations by three to four years. All these developments have shaken up the traditional workplace for many "office workers." These changes will continue in 2022.

Business travel has been a staple of the technology industry for decades. Mega-conferences, coast-to-coast sales meetings, overseas trips, routine visits to headquarters…you name it, the road warrior culture for many was real. Then the pandemic put the kibosh on nearly all corporate travel. This literal grounding, disorienting for some and liberating for others, forced companies to quickly pivot to alternative solutions for collaboration, hence the ubiquitous Zoom-type calls that let us see each other while working online (with the bonus of checking out household décor). During this stretch, some epiphanies occurred. Just as many workers discovered they could be as effective at their day-to-day jobs seated at home, many also found that business travel might not be as essential either—at least not in its historic form and frequency. That's not to say that the desire to get back on the road for many isn't there; it is. Nor that there aren't distinct business benefits that come from in-person meetings and conferences; there are. A 2020 joint study between Harvard Business Review Analytics Services and Egencia found that 60% of business leaders felt in-person collaboration is very important to innovation and delivering new products and services for their organization. The study touted having a strong travel culture. That said, business travel will be looking different in 2022 and beyond. First off, proven business travel use cases and ROI will be paramount; secondly, smaller regional conferences will be on the rise; and thirdly, more employees will be empowered to say "no" to travel requests. That last point is significant as studies have shown that younger generations of workers believe they innovate just as well with their peers virtually. Still others cite climate-awareness as their reason to avoid contributing to jets in the sky.

Regulation has been hovering over the tech industry for some time now. As technology has transformed society and tech firms have become unprecedented behemoths of industry, there has been increasing focus on curbing monopolistic practices and protecting consumer privacy. Creating new laws is complicated for two reasons. First, antitrust concepts—and even general business practices—differ from country to country. With technology able to cross borders more readily than any industry in the past, these cultural and philosophical differences get highlighted in new ways. Second, regulatory policy often focuses on issues that may not be present in the digital economy. For example, laws built to protect against price gouging aren't necessarily applicable for free internet services. With all the complications, regulatory reform will likely be a slow process, and it will be critical for organizations to stay ahead of the curve so that they understand any potential impacts on operations. In the meantime, though, the ongoing debates between government and tech firms will add fuel to an old fire. Techlash has faded as a buzzword, but the sentiment is still very real (See Appendix for data on current techlash attitudes). Across the political spectrum, consumers and clients both continue to have concerns about the market power of tech giants and the way data is being handled. As regulation plays out on a public stage, the defensive arguments provided by tech firms may contribute to mistrust of technology. The challenge for everyone involved is to fully comprehend the unintended consequences of technology, especially at massive scale, and to build a framework for responsible behavior. Tech firms in particular, regardless of size, should help lawmakers understand the issues, carefully examine their own operations, and practice transparency with their clients to address any concerns. Just as there has been added value in moving products from vendors to end users, there must now be added trust in ensuring that digital operations are above board.

One of the common IT narratives over the past several years has been the shrinking of the IT budget. Many CIOs are familiar with trying to do more with less, and the problem is tied back to a traditional view of IT. In the early days of enterprise technology, IT was viewed as a tactical endeavor, something that provided a necessary foundation for high-value business activity. From a financial standpoint, IT was viewed as a cost center, where companies wanted to either maintain their existing capabilities with lower budgets or improve their capabilities while keeping the budget flat. This tactical approach put constant pressure on the IT budget, but businesses today must also think about technology strategically, which changes the thinking around technology investment. New capabilities can lead to product innovation or broader customer reach, and these capabilities come through new spending, not belt-tightening. However, new financial largesse may not always appear inside the budget of the IT department. Stealth IT, where business units procure their own technology, is one reason why overall technology budgets can be hard to track. Taking the concept one step further, technology can often be an embedded component of business solutions, and the technology portion may not be explicitly defined. Consider a custom website built as part of a marketing campaign. The entire budget for the campaign may be viewed as marketing dollars, even though technology is clearly being built to meet the objective. The bottom line is that technology spending may be robust, but there may not be tech-specific line items in either the IT budget or the business unit budgets for all the tech spending that takes place. Technology opportunities are moving beyond hardware installations and software licensing into a wide array of possibilities as businesses integrate technology into their long-term goals.

For decades, the corporate mindset around cybersecurity had two primary characteristics. The first was the notion of the secure perimeter. With IT assets all co-located, it made sense that companies would plan to protect the corporate network with a firewall and individual endpoints with antivirus. In recent years, there has been plenty of discussion about the erosion of this secure perimeter as companies have moved to cloud systems and mobile devices. The second characteristic was what led to a secure perimeter in the first place: a defensive approach. Businesses held several assumptions about cyber attacks—they came from outside the organization, they were easily identifiable, they were relatively uncommon—and so these firms put all their energy and investment into building a strong defense. Those assumptions are no longer valid (if they ever were). It is clear now that cybersecurity breaches can remain on corporate networks for long periods of time, can be incredibly hard to detect, and can happen constantly. Even worse, the vulnerabilities that allowed the breaches in the first place might be unknown. While companies have taken several steps toward augmenting their secure perimeter, such as data loss prevention or identity and access management, moving toward a proactive mindset has taken longer. Momentum is building, though. Penetration testing has become a distinct role within cybersecurity team structure, and companies are seeking out new options such as cyber range exercises for training both red team (offense) and blue team (defense). Organizations are starting to realize that either internal resources or outside partners are needed to probe systems and find any weak spots. The biggest challenge is that offensive measures do not simply take the place of defensive measures. Both are necessary, and part of changing the cybersecurity mindset is accepting that intentional strategy and new investments will be required to create a modern security posture.

Houston, we have a problem. Despite the relentless drumbeat for channel firms to develop a solid cybersecurity strategy, a fair number of them still aren't getting it. According to CompTIA's 2021 State of the Channel study, 36% of channel businesses say that they are just beginning to formulate their cybersecurity strategies or, even worse, are either behind schedule or not involved in cybersecurity at all. That leaves nearly two-thirds that are on target or ahead of the game with their efforts. Even so, in that segment of firms on point with their efforts, just 28% consider cybersecurity a strategic specialty, which means that the majority do not offer more sophisticated tools and services beyond the basics of antivirus and firewall protection. This is disappointing because cybersecurity specialization is where it's at from a profitability standpoint today. Think services such as ransomware protection, penetration testing, cyber-insurance or compliance risk evaluation, among many others. Granted, there are understandable challenges and risks that come with operating a successful cybersecurity practice. These can include the never-ending need to keep up with new types of threats, meet new skills requirements, educate customers on best practices and navigate legal accountability in case something does go wrong. But those excuses need to go in 2022, particularly as an increasing number of cyberattacks have hit home for a host of MSPs, exposing their internal vulnerabilities and putting their customers at great risk. All channel firms will need to step up their game. And why not? The global cybersecurity services market is lucrative, expected to reach $192.7 billion by 2028, according to a 2021 report by Grand View Research. That's not money you want to leave on the table. So next year, expect channel firms to double down on cybersecurity to win deals and instill confidence in increasingly nervous customers. Ignoring this critical discipline puts a channel firm at a distinct disadvantage in the race to land and cement new customers for the future.

How customers buy technology has fundamentally changed and evolved. That statement should be in the heads of every channel company today, especially among those firms whose primary business model to date has been product-centric and transactional. Many factors have led to these changes in customer habits: the rise of easy-to-use/quick-to-buy online marketplaces, the surge in line-of-business tech buyers that purchase differently than IT departments do, and the influx of new types of players in the channel that do not operate their businesses or relationships with customers or vendors in traditional ways. All these factors and more have led many channel firms to reconsider their business model. One model that has seen an uptick in adoption, and is expected to continue to do so, is consulting. Consulting can mean a lot of things, ranging from technology advice services to business-related mentoring and guidance. But one thing is certain: Consulting services—especially those focused on helping customers run their businesses better while making the right technology decisions to do so—are both lucrative from a profitability standpoint and in demand. Think about it: If customers today are purchasing directly from one of the large marketplaces such as Amazon's or Google's, channel firms aren't part of that transaction. They can be part of the process, though, and that's where consulting acumen comes in. Consultants play the role of expert, helping guide customers through the things they do not know and have not considered, such as choosing the right fit for their business needs, understanding how to integrate that in with their current environment or how to secure it and ensure compliance. A business and/or technology consultant can be a vital lifeline in all these areas. In 2022, more channel firms will have a reckoning that reselling products and services in a cloud marketplace era is fading, but they have volumes of opportunity to transform or expand as business consulting experts (More on online marketplaces in the channel section below).

A company is only as good as its supply chain. It's a simple business concept, but a very real one. Without inventory, components and other parts at the ready to fulfill orders, the best-engineered product in the world isn't going to get built or delivered on time to meet demand. And that's a problem. Ask electric car phenom Tesla during its early years when back orders of its vehicles kept mounting over capacity issues. Tesla and other carmakers are experiencing a similar scenario today, this time fueled by the global semiconductor shortage that also has hindered smartphone, PC and other chip-dependent industries in the wake of COVID. The shortage has shined a light on one of the downsides of an economy where various aspects of product development, manufacturing, inventory and delivery are dispersed across the globe. For decades now, the concept of just-in-time manufacturing has been heralded as a way for manufacturers, suppliers and providers to stop stockpiling inventory and parts, instead responding as close to real-time as possible to demand for goods. The chip shortage debacle is calling this method into question in some tech circles, which are now wondering if it might be wiser to keep inventory, parts and components close to home, regardless of whether customer orders have been placed yet. This, they contend, could avoid the supply chain backlog problems that have resulted in long wait times during COVID. The channel, often the last link to the customer, relies on accurate information from its partners upstream—OEMs, distributors, etc.—as to the availability and ship time of products. Lacking that, they unfortunately risk incurring customer wrath. To avoid this in 2022, channel firms, particularly the hardware-focused, may begin to consider holding some inventory of their own in the event of component or other backlogs overseas.

Software development used to be the domain of large companies. Technology adoption always starts as an expensive endeavor. Only the biggest companies could afford the first mainframes, and only these large companies could initially afford programming skills to capitalize on the infrastructure. For decades, most other companies relied on packaged software, where the base functionality still provided huge benefits. The situation has changed, though. As the foundational computing platform has stabilized and technology has become democratized, companies have evolved their investment strategy to capture competitive advantage. Driven by the desires to customize and automate, more and more organizations have started adding software development skills. One big reason for broader adoption is that the approach to software development has changed. Rather than using massive development teams to build monolithic applications, companies have lowered the barriers to entry by relying on open source and microservices. Cloud computing also plays a role, as companies can stand up multiple environments for development, testing and production without sinking the capital investment needed for hardware to run these environments. Software applications continue to grow in number and complexity as businesses leverage technology to connect their workforce, reach new customers and improve productivity. Unfortunately, the skill supply cannot keep up with demand. As a result, organizations will keep trying to stretch their development efforts by breaking applications down into bite-size pieces. Not only can these smaller functions be refreshed more quickly, but they can also be reused throughout a comprehensive software strategy. Whether this is an evolution of microservices or a new approach such as Gartner's composable applications, the trend of reusable pieces of software will simplify development but add challenges in integration and architecture management. In order to manage the second-order effects of granular applications, companies will also accelerate their adoption of DevOps, with the most advanced companies exploring AIOps to further automate their established processes.

As the newest area within the functional IT framework, the field of data is still in nascent stages at most organizations when compared to infrastructure, software development or cybersecurity. There is certainly a spotlight on the data space; data science is commonly cited as one of the fastest-growing job roles (30% growth by 2030 according to CompTIA's Cyberstates report). One reason for this is that there are currently less data scientists compared to other technology roles. With a small base, it takes fewer new additions to achieve significant growth. That still doesn't change the fact that companies are aggressively pursuing analytics as a strategy. The promise of analytics is that it can describe past business transactions, improve current business operations and predict future business opportunities. However, realizing that promise requires a structured foundation of corporate data, and many companies are still struggling to build this. Data silos and non-existent data policies are hurdles that get in the way of natural language processing, machine learning or AI-driven automation. Although businesses are eager to reap the benefits of these advanced tactics, moving fast will almost certainly break things without producing many useful results. In order to begin using analytics as a tool to take business operations to the next level, companies have to start with data basics. This starts with an assessment of all corporate data to understand where it lives and how it is used, a classification of all data to define requirements around usage and security, and a strategy for data to outline goals and identify tradeoffs. From there, most companies may want to update their storage schemes or ensure that they are getting the most out of traditional tools like relational databases. Only at that point are organizations ready for tools that work with unstructured data, algorithms that leverage machine learning or models that rely on real-time data streams. Business will be done differently in the future thanks to data analytics, and the companies with a strong data foundation will lead the way.

Industry Overview

While the specifics of the technology industry continue to reveal a strong and growing sector, the most important characteristic of technology is the extended impact on the global economy and the job market. In many ways, the lines are becoming blurred between the direct growth of technology and the indirect influence it has on every business and every facet of life.

Data from the consulting firm Bain & Company shows how technology has led the way in global economic growth. The largest growth comes from "born tech" companies, which have technology as a central part of their identity. These firms have contributed 52% of total market value growth since 2015. Another 20% of market value growth has come from companies with a tech-led strategy that augments more traditional models.

Along the same lines, CompTIA's Cyberstates report describes the economic impacts of the technology industry. The direct economic impact—the dollar value of goods and services produced during a given year—amounts to 10.5% of U.S. economic value, which translates to over $2.0 trillion. Beyond this, there are indirect impacts, such as every job in IT services and custom software development leading to an estimated 4.8 additional jobs created or supported through direct, indirect or induced means.

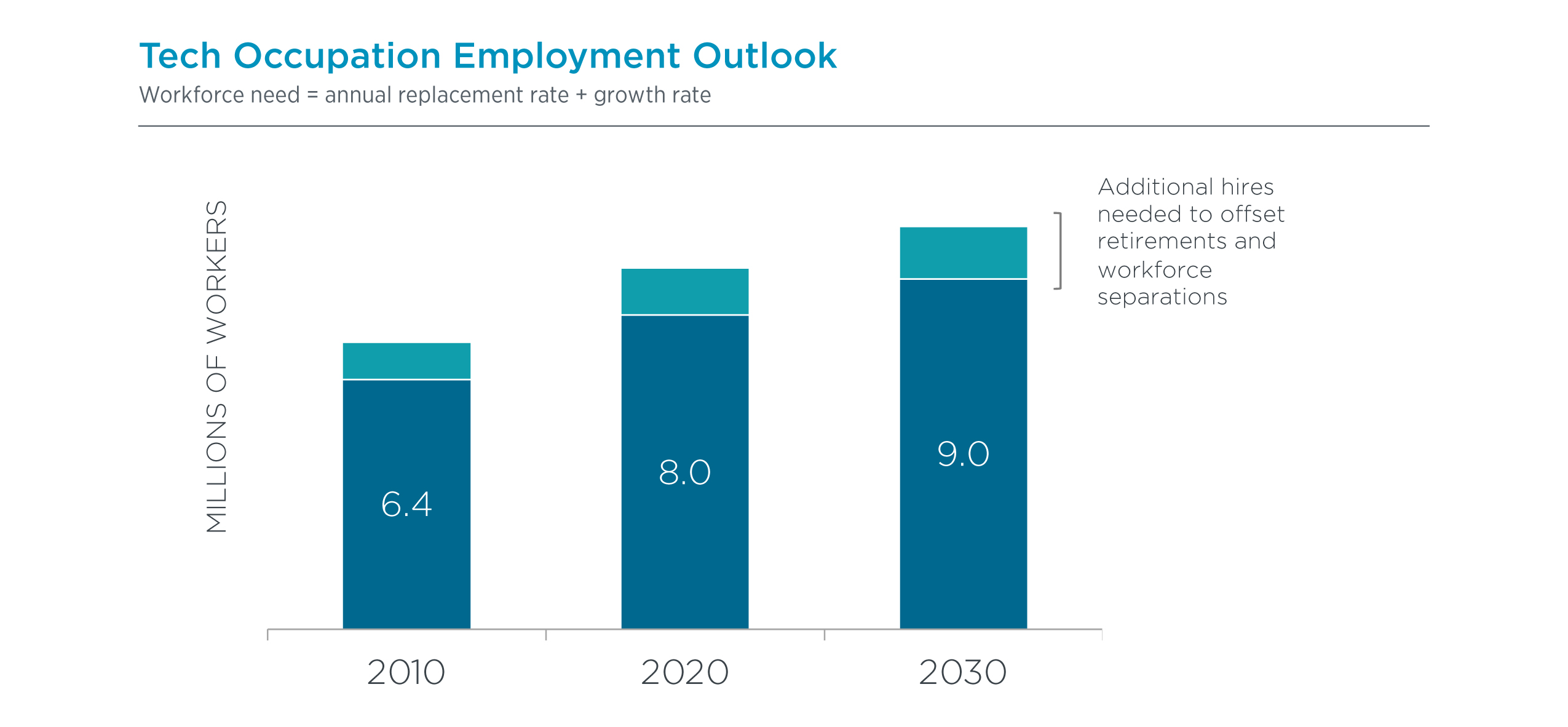

Employment is one of the most significant aspects of the technology industry. For many years, technology employment has been more robust than overall employment, with lower unemployment rates and stronger job prospects. Looking forward, tech occupation employment is expected to grow at about twice the rate of overall employment in the U.S., with many occupations growing at 4x-5x the national rate. Cyberstates provides greater detail behind this trend.

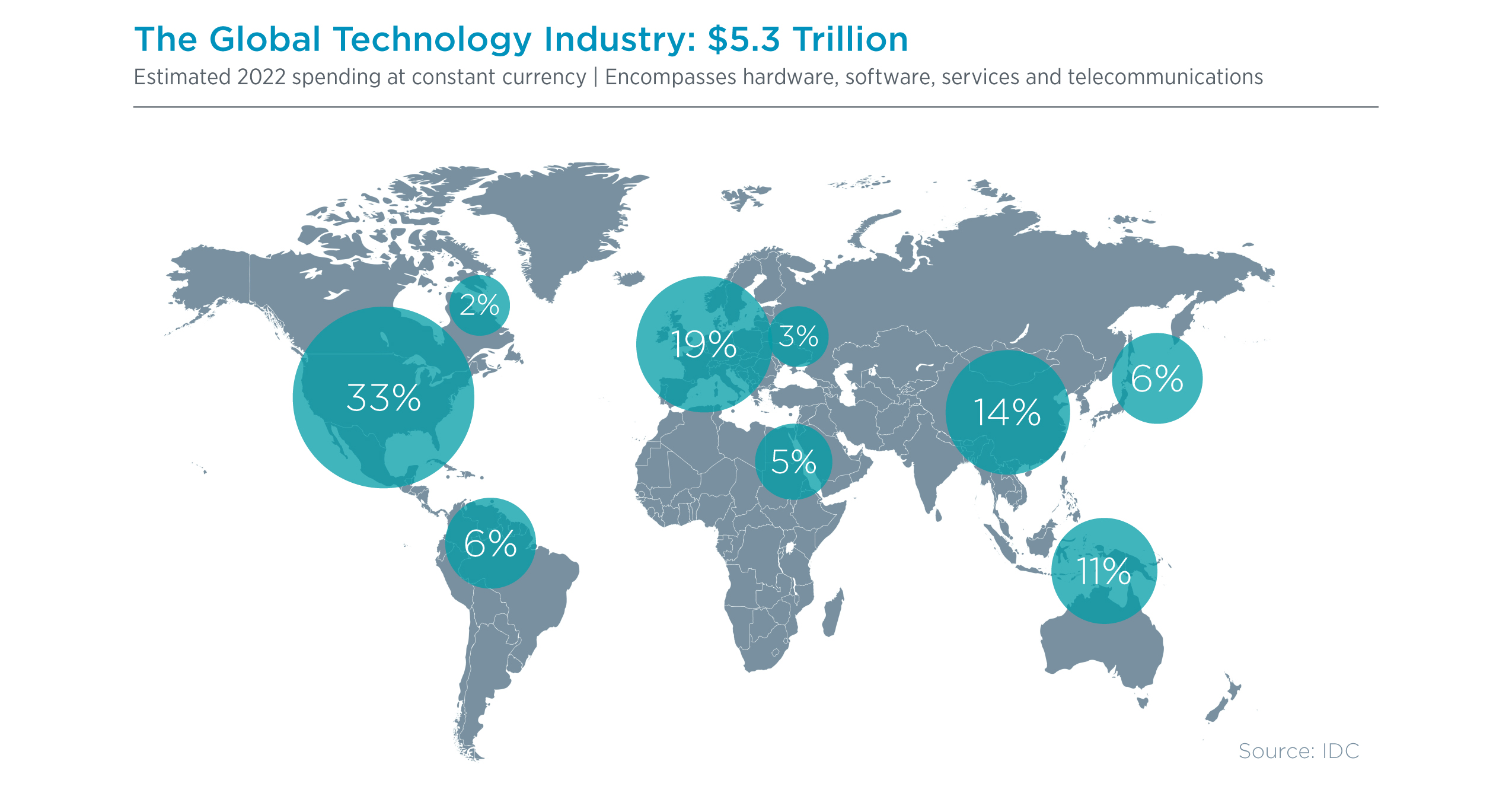

In terms of industry specifics, IDC projects that the technology industry is on pace to exceed $5.3 trillion in 2022. After the speed bump of 2020, the industry is returning to its previous growth pattern of 5%-6% growth year over year. The United States is the largest tech market in the world, representing 33% of the total, or approximately $1.8 trillion for 2022.

Among global regions, western Europe remains a significant contributor, accounting for approximately one of every five technology dollars spent worldwide. As far as individual countries go, China has clearly established itself as a major player in the global tech market. China has followed a pattern that can also be seen in developing regions, where there is a twofold effect of closing the gap in traditional categories such as IT infrastructure, software and services, along with staking out leadership positions in emerging areas such as 5G and robotics.

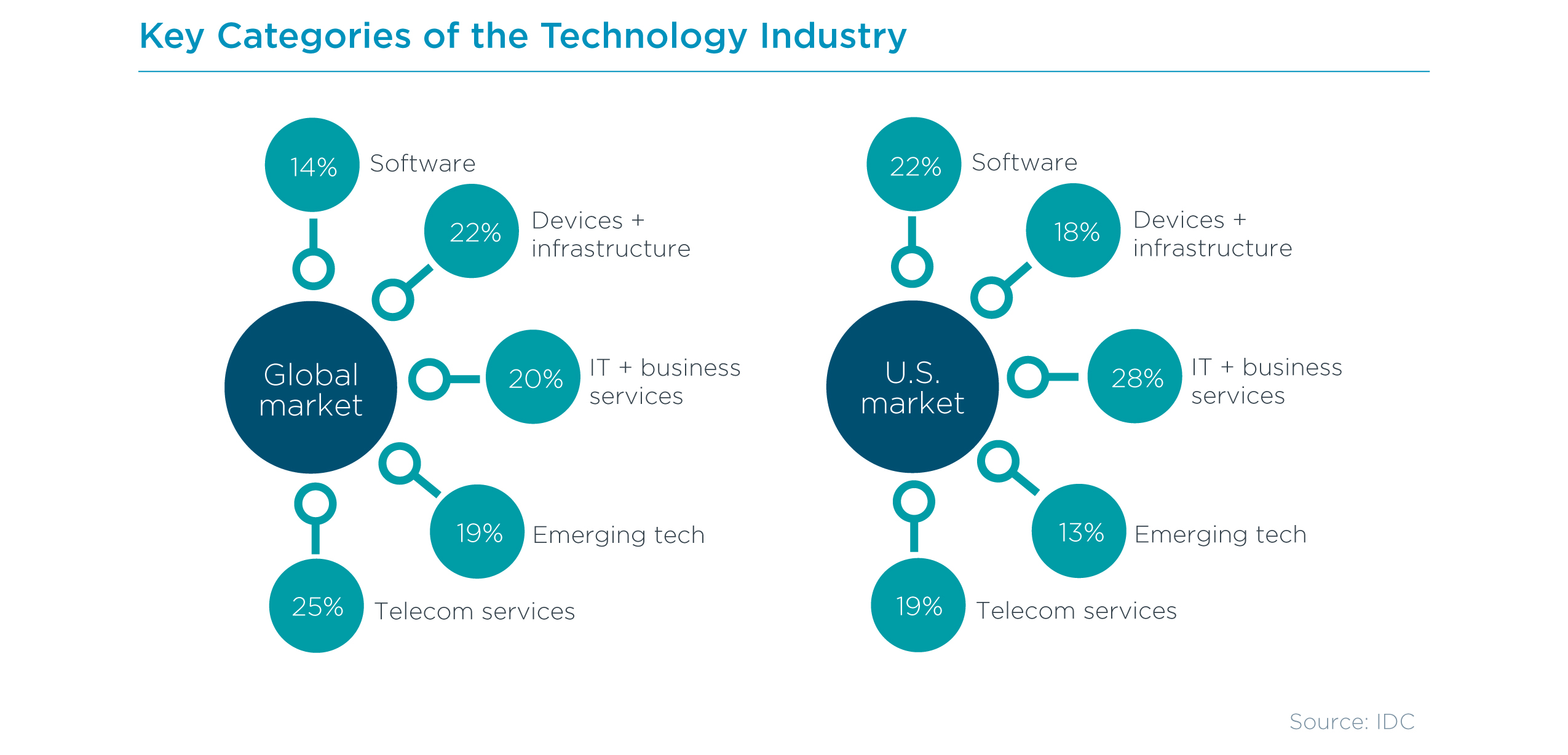

There are a number of taxonomies for depicting the information technology space. Using the conventional approach, the market can be categorized into five top-level buckets. The traditional categories of hardware, software and services account for 56% of the global total. The other core category, telecom services, accounts for 25%. The remaining 19% covers various emerging technologies that either don't fit into one of the traditional buckets or span multiple categories, which is the case for many emerging as-a-service solutions that include elements of hardware, software and service, such as IoT, drones and many automating technologies.

The allocation of spending will vary from country to country based on a number of factors. In the mature U.S. market, for example, there is robust infrastructure, a large installed base of users equipped with connected devices and abundant bandwidth for these devices to communicate. This paves the way for investments in the software applications and technology services that sit on top of this foundation.

Software and tech services make up half of all spending in the U.S. technology market, significantly higher than the rate in many other global regions. Countries that are not quite as far along in these areas tend to allocate more spending to traditional hardware and telecom services. Building out infrastructure and developing a strong tech-savvy workforce does not happen overnight. Scenarios do exist, however, whereby those without legacy infrastructure—and the friction that often comes with transitioning from old to new—may find an easier path to jump directly to the latest generation of technologies.

The enormity of the technology industry is a function of many of the trends discussed in this report. Economies, jobs and personal lives are becoming more digital, more connected and more automated—a trend that is only accelerating after recent events. The platform for computing has become much more stable, with access to technology no longer limited by location or constrained to certain activities. As a result, more energy is pouring into creative solutions, further expanding the opportunities for both IT professionals and IT channel firms.

While the high-tech industry is a significant economic player on its own, it also indirectly influences a wide range of other activity.

- Job creation. Throughout history, technological advancements have ultimately led to growth in job opportunities. The key word there being "ultimately." According to The Future of Jobs 2020 report from the World Economic Forum, technology will potentially disrupt 85 million jobs globally by 2025, but 97 million new roles will potentially emerge.

- Portfolio diversification. As described by the data from Bain & Company, many companies are finding ways to use technology to augment their existing offerings. For example, Disney's Q1 2021 revenue was $16.25 billion, which was down 20% year over year, but which would have been much lower if not for 73% growth in their Disney+ streaming service.

- E-commerce. The U.S. Census Bureau found that U.S. e-commerce sales grew 30% in 2020, accounting for 14% of all U.S. sales. That's a jump from 11% in 2019. As e-commerce changes buying habits, it is also changing physical retail space and shipping logistics, the latter of which is leading to a reimagining of supply chains.

- Workforce diversity. While the tech industry itself has been fairly chastised for a poor track record on fostering workforce diversity, other industries that use technology ubiquitously (just about all today) have not. So, industries like retail, finance, manufacturing, healthcare, non-profits and beyond have become welcoming places to land for tech-oriented workers regardless of race/ethnicity, gender, age, etc.

- Climate impact. As with workforce diversity, there are certain aspects of the tech industry that are negative for the environment (the energy used for mining cryptocurrency comes to mind). However, there are also positive effects, from the use of IoT in controlling utility consumption to the reduction in travel thanks to remote access and collaboration tools.

- Smart cities. The conversation around smart cities has been drawn out as traditional city planning activities and budgets try to account for new technology. The discussion is likely to continue for the foreseeable future as first-order steps such as sensor installation lead to second-order effects such as data analysis that can drive overall infrastructure decisions and citizen services.

- Health. From blood pressure to glucose levels, technology solutions such as wearables are making it easier for people with heart ailments, diabetes and other chronic illnesses to keep real-time track of their health status. This type of monitoring will continue into the future as more data can be collected from a person and sent directly back to a medical professional to analyze, which will aid in diagnosis, ongoing treatment and proactive decisions before a person is in a health crisis.

- Education. Learning got a sharp wakeup call during COVID, with an abrupt move to online classes for students as young as kindergarten on up through college. The grind of Zoom calls and the distractions of home may have been challenging, but they further proved that the use of technology as part of the education puzzle is here to stay. Whether it's during remote learning or in-classroom, new applications, devices and other tech solutions will continue to make their mark on how today's young people are educated, bringing a flexibility to learning not seen in the past.

IT PROFESSIONALS SEE BROADER OPPORTUNITIES

For IT professionals, a return to strategy within their organizations means that career options are more promising than ever. Prior to the pandemic, companies had begun embracing a dual approach to IT. The tactical side was the more traditional approach, ensuring that infrastructure and applications were in place to support business activities. The strategic side was the cutting-edge approach, incorporating technology as a critical component of new objectives. The chaos of the pandemic gave IT pros career stability as they addressed immediate concerns, and the promise of recovery gives even more stability as IT pros contribute to future success.

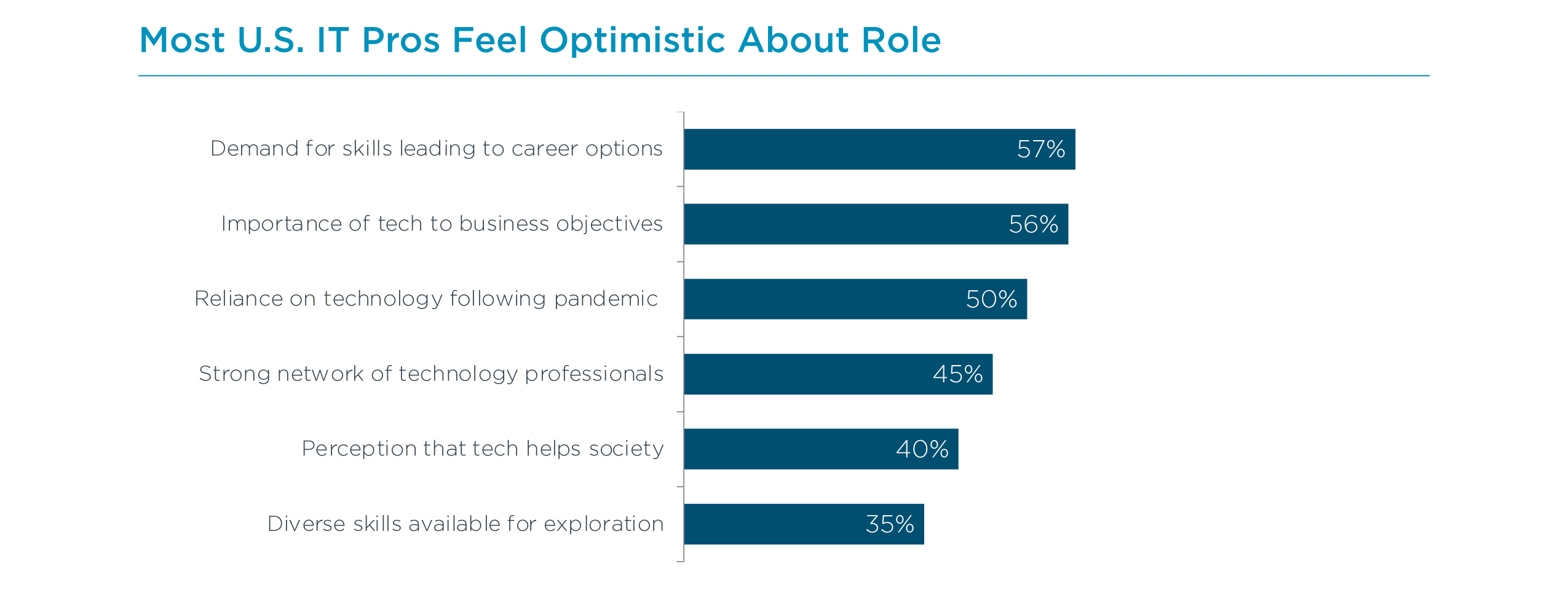

As with last year, IT professionals overwhelmingly have a positive outlook for their job prospects. Nearly 80% of IT pros feel good about their role as a technologist, with 19% having mixed feelings and a very small minority feeling concerned. Lingering uncertainty around COVID remains a concern, especially as some sectors may take longer to recover. Challenges around growing complexity also weigh heavily, which fits in with new directives to handle both tactics and strategy.

The two-sided nature of enterprise technology provides more reason for hopeful career trajectories, though. Companies continue to struggle in finding the skills they need, even for day-to-day operations. As companies increasingly push the envelope of technology in order to gain competitive advantage, it opens the door wider for career mobility. That mobility doesn't necessarily have to come from changing companies; organizations are showing more willingness to train their current workforce so that they retain institutional knowledge and ensure an exact skill match.

As described in the trends section, technology budgets are becoming somewhat difficult to define. Technical training is another example of blurred lines: Does that training have to be done within departmental budgets, or are there general education dollars? The deeper technology is embedded within an organization, the more difficult it becomes to define the "technology budget."

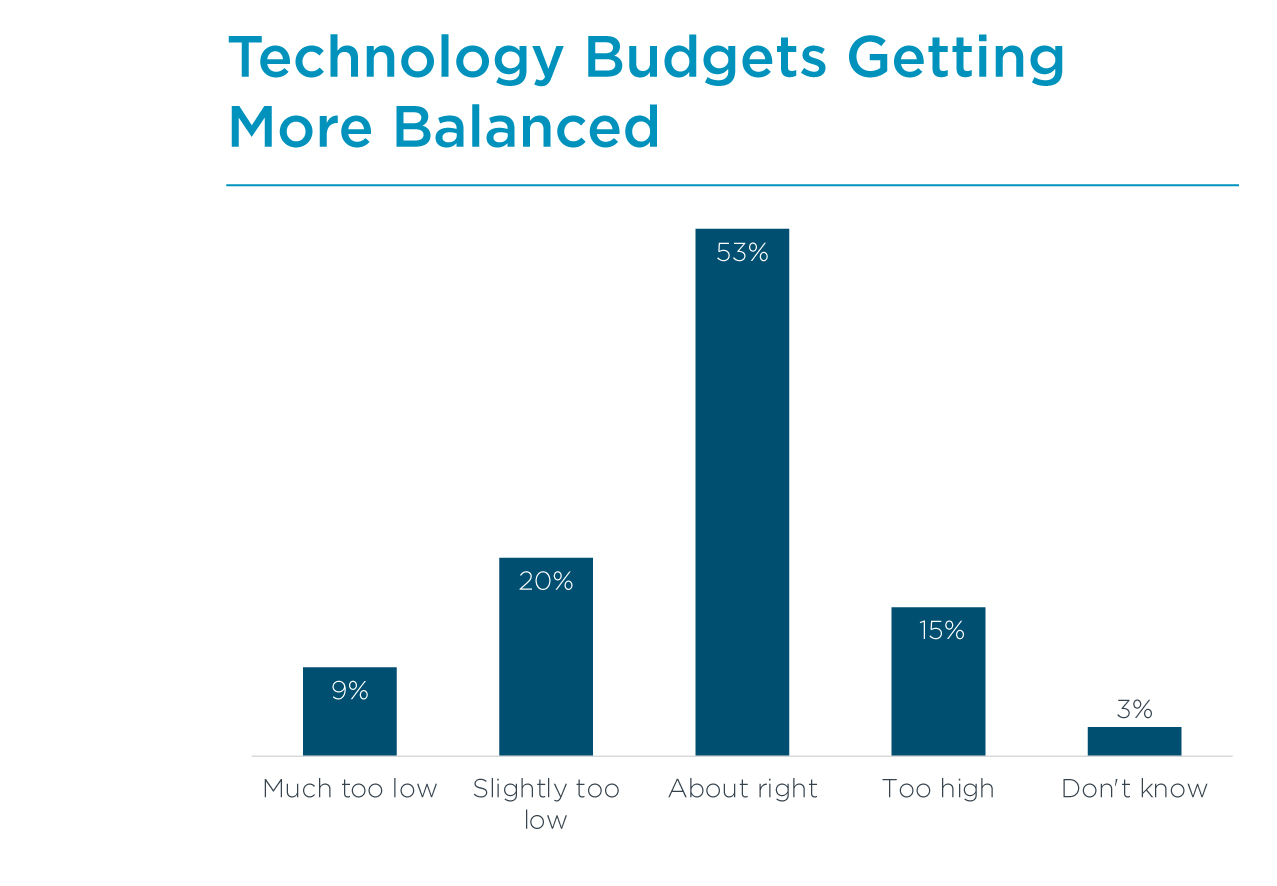

With that said, the return to strategy also seems to be bringing more balance to the views around the technology budget. In 2020, only 40% of IT pros felt like the technology budget was right-sized for the challenges they were facing. This year, that number has climbed to 53%. This sentiment is likely to swing back and forth based on general economic conditions and individual company plans, but the increase is a good sign that businesses are moving out of panic mode.

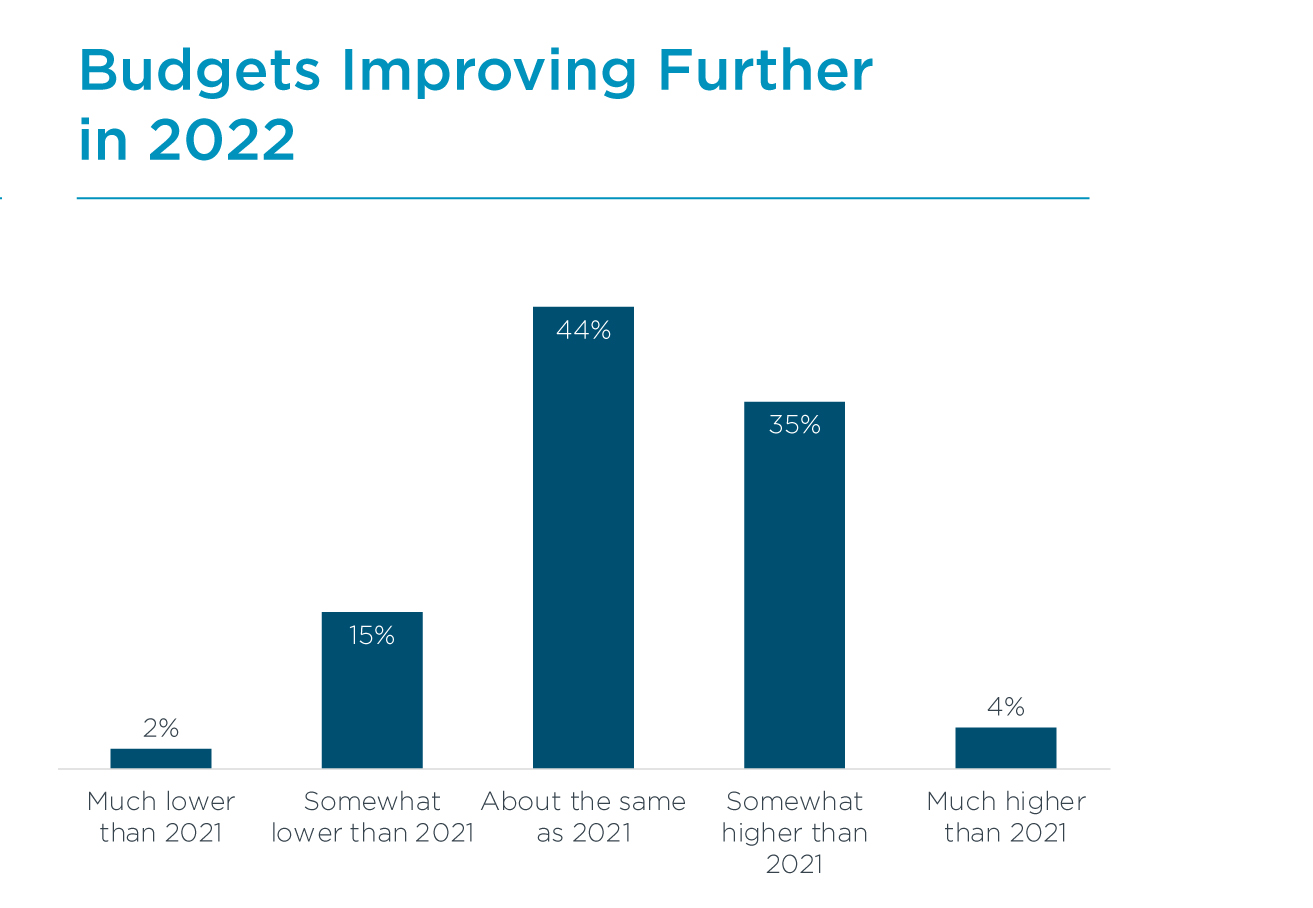

Adding to the rosy financial picture, a large number of IT pros believe that budgets will be higher next year than they are now. Nearly four out of ten IT pros see budget increases for 2022, compared to only 18% who were predicting increases at this time last year. As always, the threat of the unexpected hangs over these hopes. Although the COVID threat seems to be abating, it remains the greatest unknown of our lifetime. In addition, geopolitical dynamics have highlighted how fragile the ecosystem can be, especially for supply chains or regulated activities.

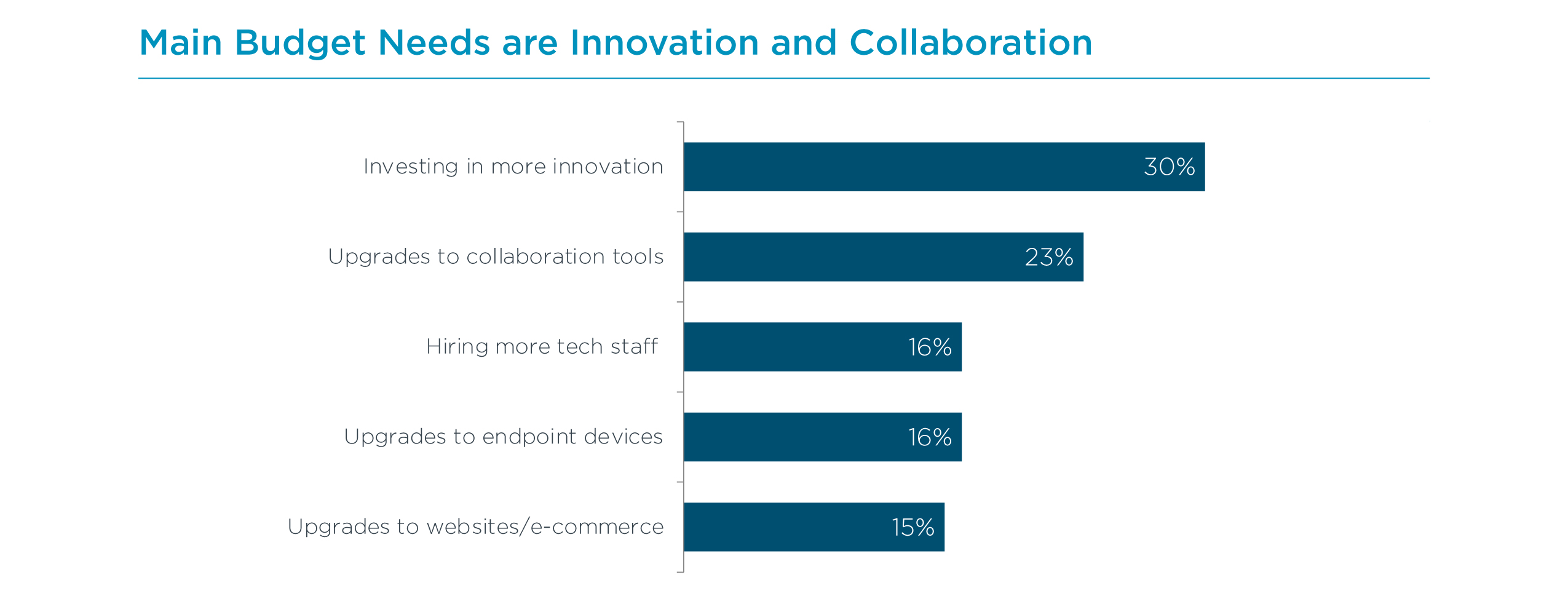

If the budget increases do come to pass, there are two clear areas where IT pros see the need for additional investment. The first item on the wish list is innovative, cutting-edge technology. Once again, this is a sign of a more strategic approach. The subtlety here is that the technology itself is not necessarily the objective. After years of emerging tech being in the spotlight, the pattern for adoption has become more clear. Individual technologies such as IoT or AI are not purchased and implemented directly. Instead, these trends factor into broader solutions that benefit a company's operation, such as automation or product development.

The second area where IT pros would like to invest is in collaboration tools. However the workplace might be defined in the long term, it will at a minimum include a greater degree of flexibility and most likely be significantly more distributed. As companies find the right balance for their particular culture and objectives, they will want to be sure that they are maintaining productivity and enabling innovation. The tools may not be the primary hurdle—Zoom fatigue is real—but the right tools and infrastructure are table stakes for the workforce of the future.

Looking deeper at skills, the IT workforce keeps evolving from a heavy focus on infrastructure and generalists into a diverse world of specialists spread across four fundamental disciplines. CompTIA's IT framework defines infrastructure, software development, cybersecurity and data as the pillars supporting IT operations. Looking at each area individually highlights the layers of complexity that companies are dealing with as they try to build the best skills within their workforce.

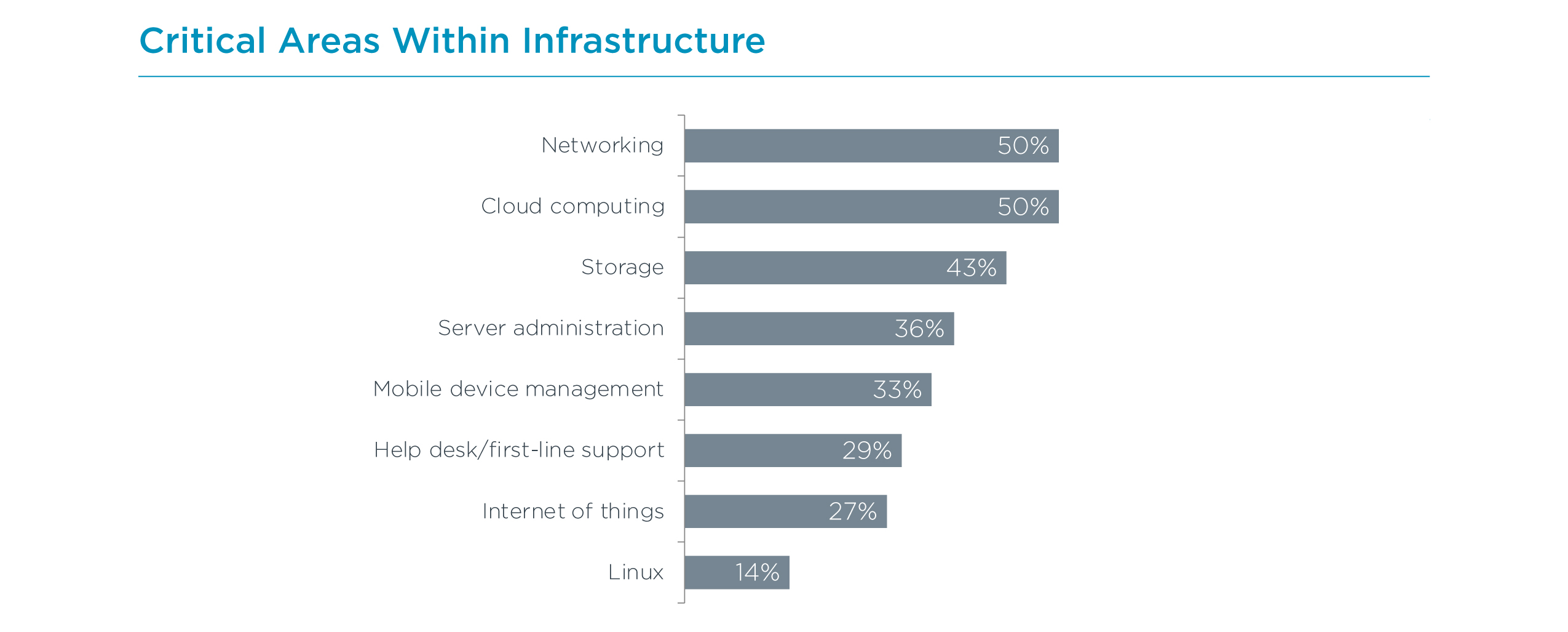

Starting with infrastructure, companies will continue to pursue a cloud-first architecture. This means considering cloud as the first option for new components and migrating existing systems where the cost/benefit analysis makes sense. As companies place more of their IT architecture in the cloud and consider new options for their workforce, networking performance becomes more critical. Other backend components such as server administration and storage are also part of a broader modernization of the IT building blocks. Nearly one third of all companies are placing focus on first-line support, proving that the help desk has still not become a commodity in an age of outsourcing and end user tech savvy. The emerging area of IoT continues to be a minor focus area, continuing the path of measured adoption that was taking place pre-pandemic.

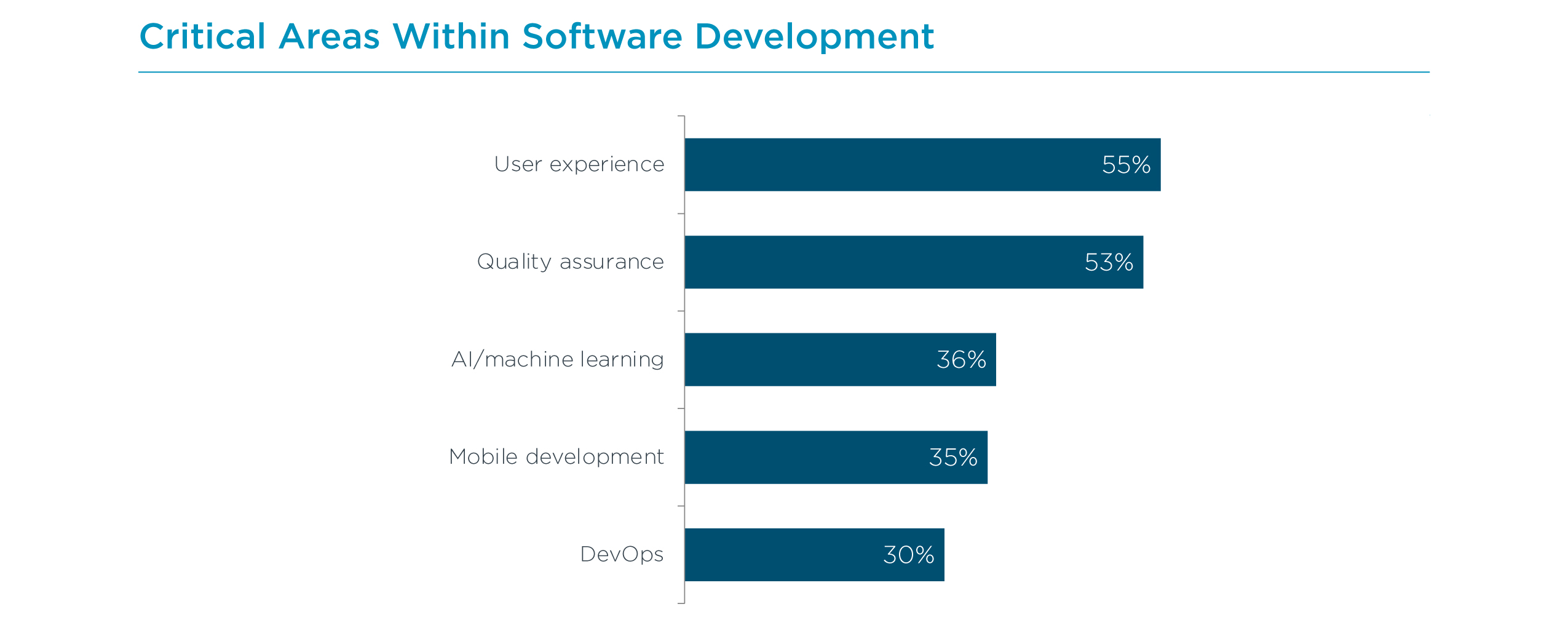

Whether dealing with internal stakeholders or external customers, companies continue to emphasize user experience in the area of software development. The app approach that became widespread with the explosion of mobile devices redefined expectations around software usability, and many companies are still climbing the learning curve. The need for quality assurance is tied to the speed of development cycles, as organizations are trying to accelerate their processes without disrupting workflow. Artificial intelligence and machine learning take a step forward this year as companies shift back to pursuing advantages with intelligent algorithms, and the skills needed are both in developing the algorithms and managing the outcomes. As companies build out their software capabilities, they will drive more interaction between software development and infrastructure operations, leading to more demand for DevOps.

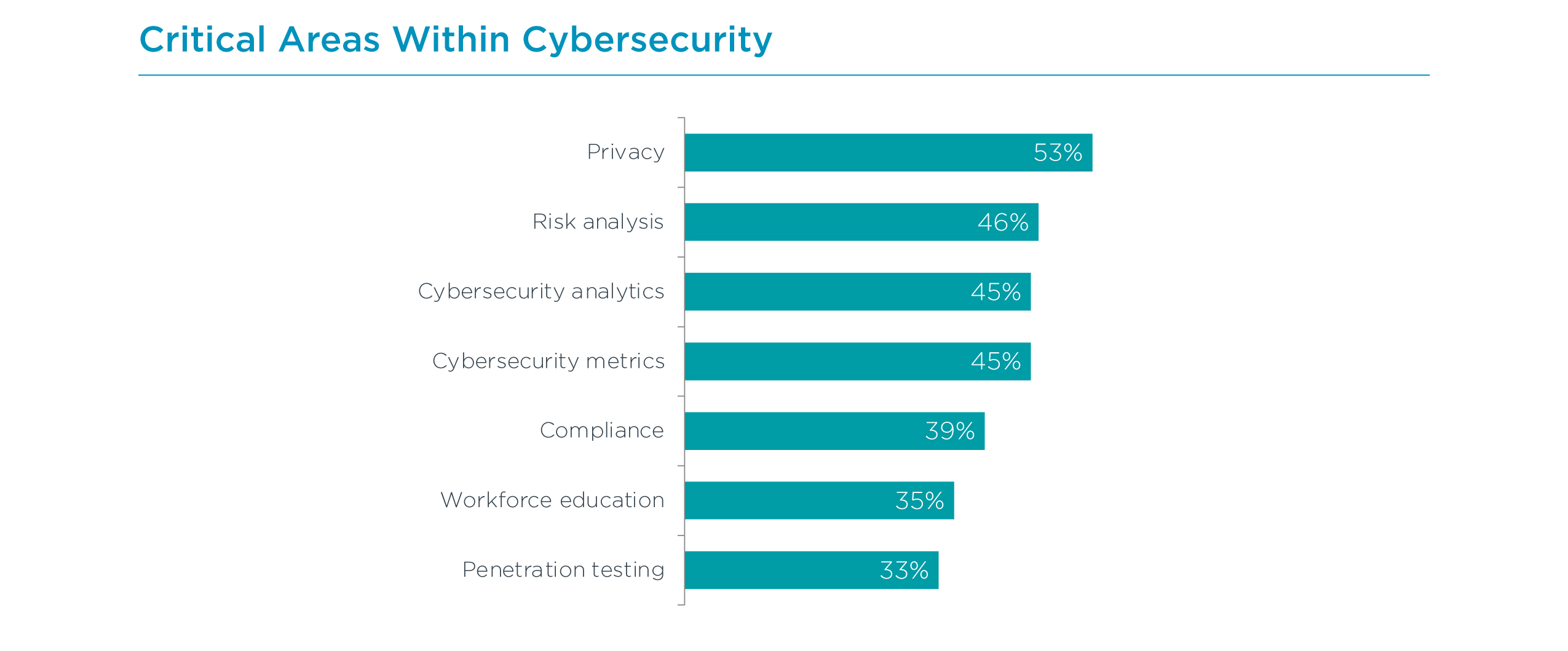

Cybersecurity is possibly the most complex of the four pillars, covering expanded defenses that companies must build, innovative approaches to proactively test those defenses, and internal processes that create secure operations. Privacy is top of mind as the uses of data in a digital economy continue to be scrutinized. Risk analysis, cybersecurity analytics and penetration testing are all areas that need improvement as companies adopt a zero trust mindset. Cybersecurity metrics are starting to get more focus as a way of bridging the gap between cybersecurity best practices and business health. Workforce education is possibly underrated as a priority. New concerns that stem from a remote workforce have been a primary trigger for both security awareness education and security investments.

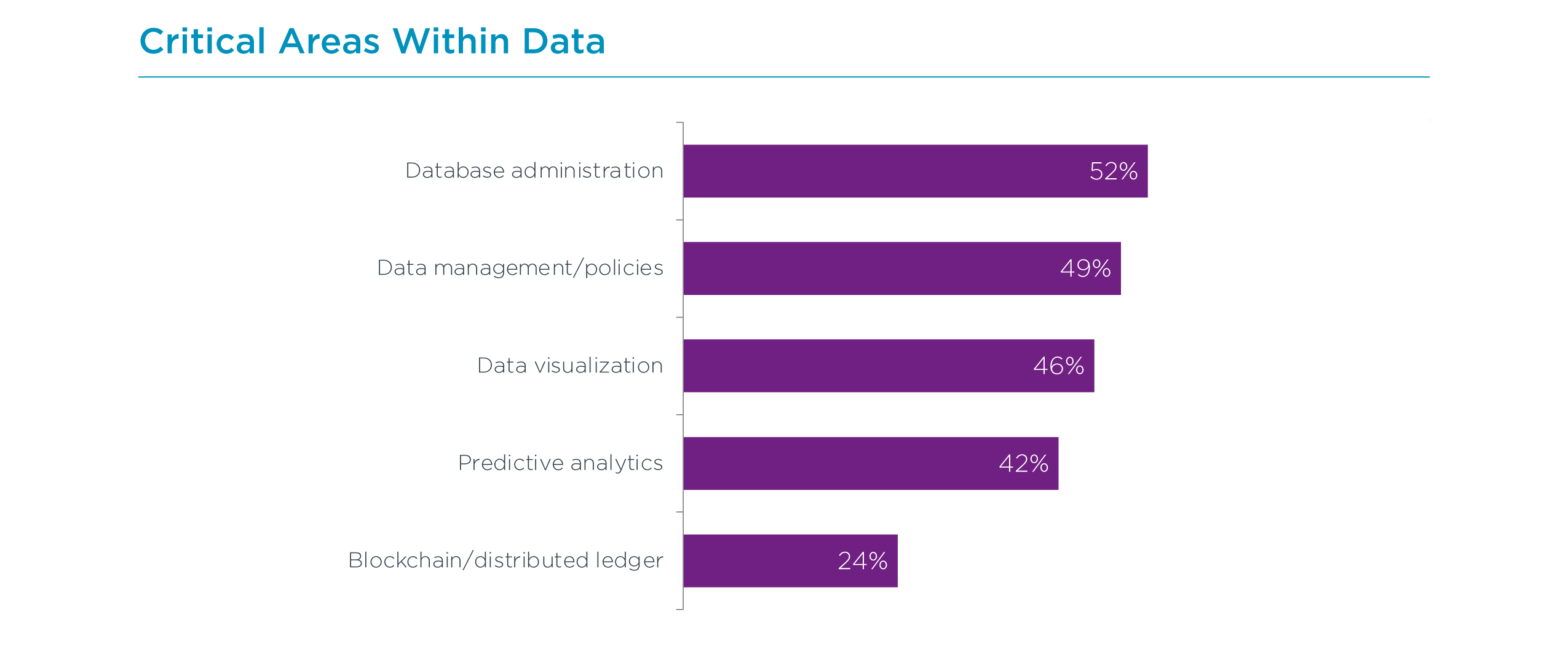

Finally, the field of data is not set up to be a dedicated function as often as cybersecurity, but it is still a field where businesses are trying to establish comprehensive policies and management. Database administration is still the top focus area heading into 2022, as many companies continue to move away from spreadsheets and other simplistic forms of data management. The emphasis on data management and policies shows that businesses are beginning to take a more comprehensive approach to their data, which in turn will drive more specialization. While data visualization and predictive analytics have relatively strong demand, those areas are still difficult to tackle without a holistic data management strategy. As far as cutting-edge technologies, distributed ledgers such as blockchain have tremendous potential, but there are still hurdles in implementation and the technology will most likely remain a degree separated from most end users.

Adding to the challenge of filling a broad range of skills, companies are generally looking for candidates with deeper expertise. Across all four IT pillars, hiring companies are primarily targeting either early career (3-5 years of experience) or mid-level (6-10 years of experience). In fact, the focus on this level of expertise is slightly greater than it was heading into 2021. Targeting a higher level of experience may make sense in the areas of infrastructure and software development, where businesses have built a hierarchy of skills over time. For cybersecurity and data, the situation is more complicated. These areas, which have traditionally been subsets of infrastructure and development, have relied on those foundational pillars to provide the entry level skills. Now that they are distinct functions, there are difficulties in creating the pipeline for more advanced talent. Over time, entry-level positions will likely emerge, but in the meantime, companies will have to explore different avenues for filling their skill gaps.

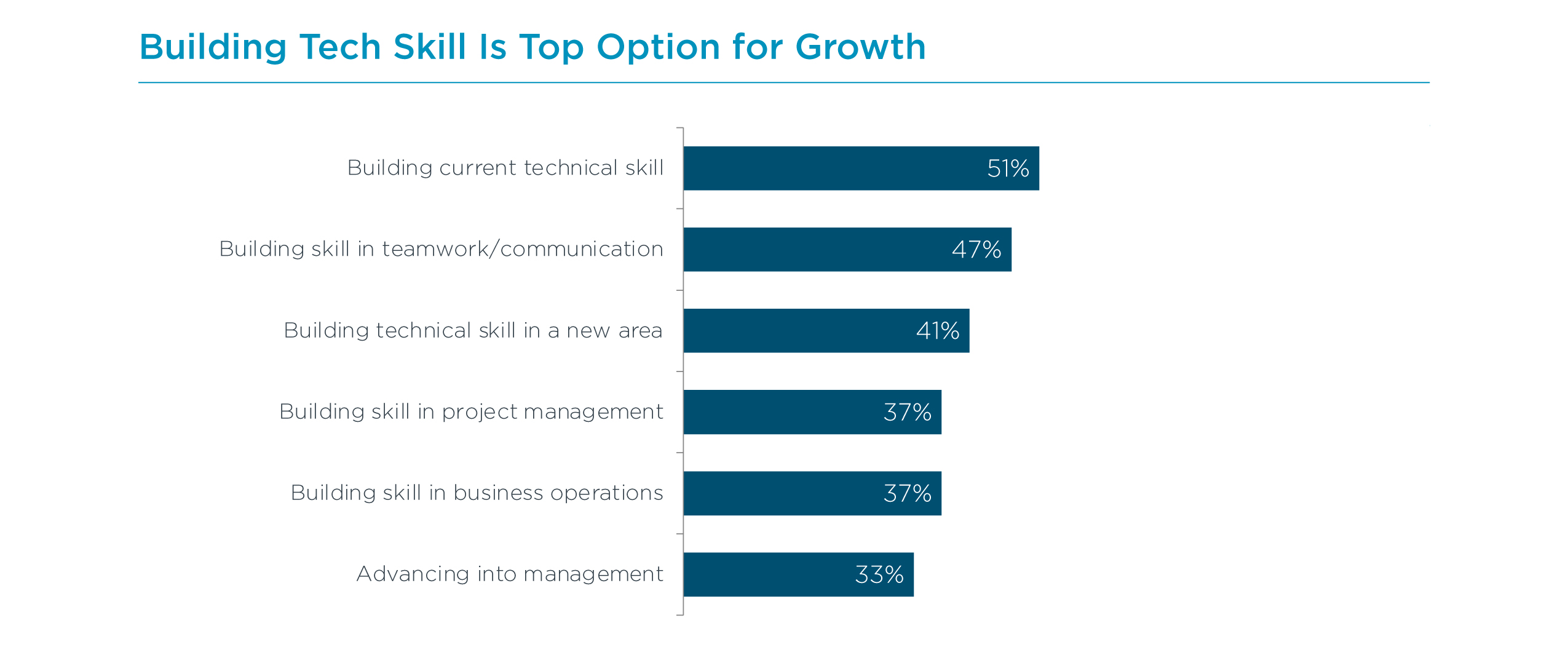

There is greater interest in new hiring for 2022 compared to 2021, but the preferred method of closing skill gaps is still training the existing workforce. Only 47% of companies expect to bring on new headcount in 2022, compared to 71% that plan on pursuing training options. In addition, 46% of companies plan on certifying their workforce, which validates strong skills around the latest technology. When it comes to career growth, there are three distinct areas IT pros expect to develop. First is technical skill within their existing specialization. With so many different topics within each pillar, there is plenty of room for growth. Second is teamwork and communication. As technology regains a more strategic flavor, there is a greater need to explain technical hurdles and cooperate on unique solutions. The final focus for career growth is technical skill in a new area. The four pillars interact in unique ways, and these overlaps define how business solutions are built and maintained.

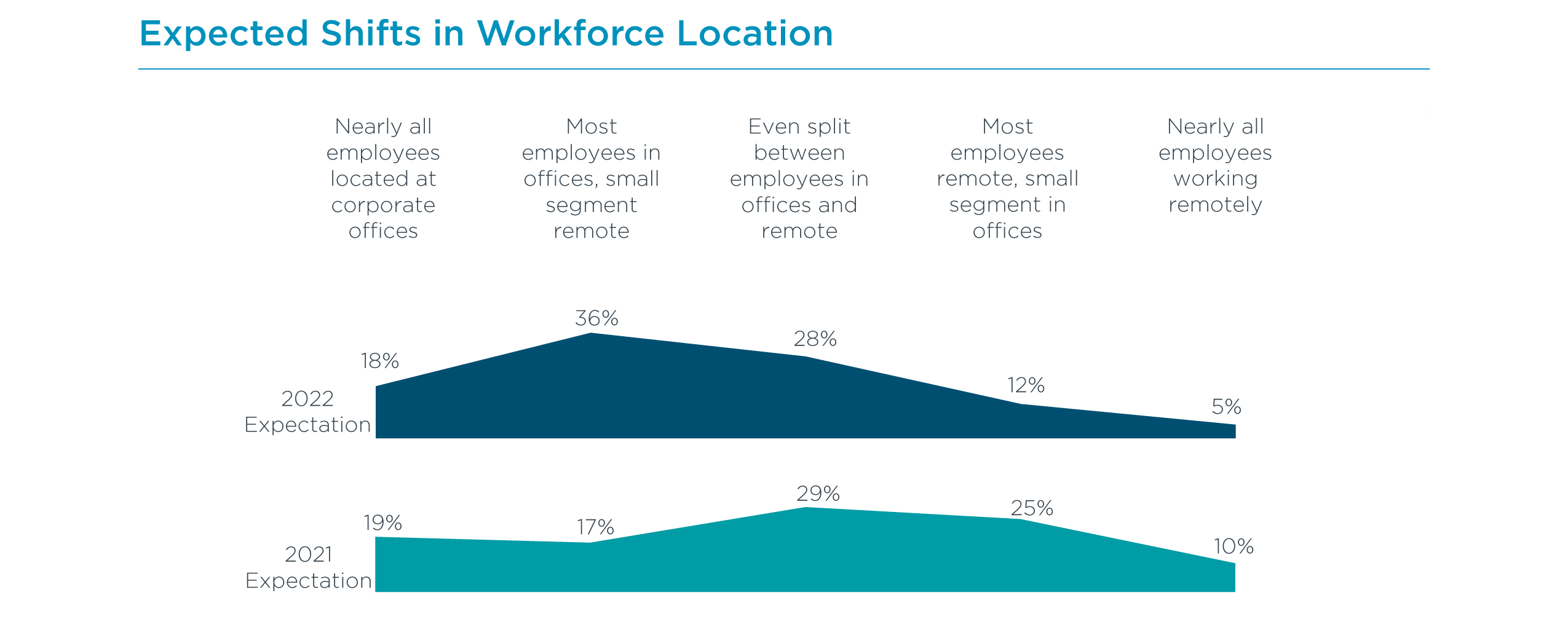

There are two other topics for 2022 that impact the IT pro outlook to varying degrees. The first is the location of the workforce. Expectations for 2022 are clearly still different than pre-pandemic levels, but there is certainly some movement back toward workers being located in offices compared to 2021 expectations. Much has been written about employees rejecting this arrangement. While CompTIA's sample is a single data point, it provides a counterargument. Of the IT pros who believe that their company will plan for most or all employees to be based in corporate offices, only 10% say they are definitely looking for a job with more location flexibility because of their company's decision.

The willingness to remain in an office-based job may be related to the nature of IT work. Over 70% of IT pros say that they plan to be at an office full-time or the majority of the time, which is clearly more than the percentage of companies mandating a return. There are certainly a number of challenges involved with doing technology work remotely, including difficulty collaborating with technology colleagues (cited by 40%), difficulty focusing on complex problems (cited by 39%), and a preference by employees for in-person discussions (cited by 35%). As organizations are discovering how to rebuild the workplace, IT pros will also be discovering how to adjust to the situation.

The other topic looming in 2022 is not exactly a new issue. Diversity has not been solved, especially not in the field of technology. IT pros are aware of the problem—53% believe that there is more diversity in the broader organization than within the IT department, and only 7% believe the IT department as more diversity—but they may not know what to do about it. Although mandatory trainings have become a cliché, there are serious issues around creating inclusive spaces, and every employee should consider themselves part of the solution.

The past year has shown that progress is never a guarantee. There are still questions about the future, but the light at the end of the tunnel is growing brighter. Even with some lingering doubts, companies are returning to the technology mindset that had been developing throughout the past decade. The critical nature of IT, both for maintaining operations and for pursuing new growth, creates encouraging prospects for IT pros as they build their careers.

THE BUSINESS OF TECHNOLOGY PREPS FOR BETTER FORTUNES, NEW INITIATIVES

Much like IT professionals, companies in the business of technology (aka the channel) are starting to think bigger again, rekindling some of the strategic initiatives and aspirations that may have been put on the back burner during the extended pandemic. Even among those firms that have struggled during COVID, there is a sense of renewed yet cautious determination entering 2022. Whether it's building back a solid foundation that had cracked a bit these past couple years or forging ahead with ambitious business decisions aimed squarely at the future, the channel seems ready to accelerate.

Consider this glass-half-full assessment: Nearly eight in ten channel companies in this year's study said they are positive about their firm's prospects for 2022, including 37% that are feeling "very good" and 40% feeling "pretty good." That's a nice bump up from the 63% that felt similarly about their own company a year ago. Among the glass-half-empty contingent? Just 5% this year said they feel uneasy or very uneasy about their business prospects as we turn the calendar page to 2022.

There is no doubt that technology and the business of selling it continues to be ever more vital to everyday life. The industry itself is more complex and changing rapidly at both the technology and business levels. From the channel's vantage point, what was once a stable set of infrastructure products in a reseller's portfolio has, in the cloud age, morphed into a cornucopia of software-as-a-service applications, data and cybersecurity tools, and a stack of emerging technologies to contend with. At a business model level, consulting and influencing have established themselves as legitimate—often lucrative—paths to pursue. Finally, one of the most consequential developments affecting the channel today is the rise of online marketplaces, which upends the entire buying process and impacts actions that follow.

Looking ahead to 2022, firms that manage to thrive will be hiring again, making investments in skills training, expanding their market reach to new customers and verticals, partnering with competitors and embracing emerging tech. For many, that means getting out of their comfort zone. And many are ready to do so. After nearly two years of stasis and economic uncertainty, signs now point to investment and the pursuit of technical and business innovation that pairs well with the direction the industry is heading.

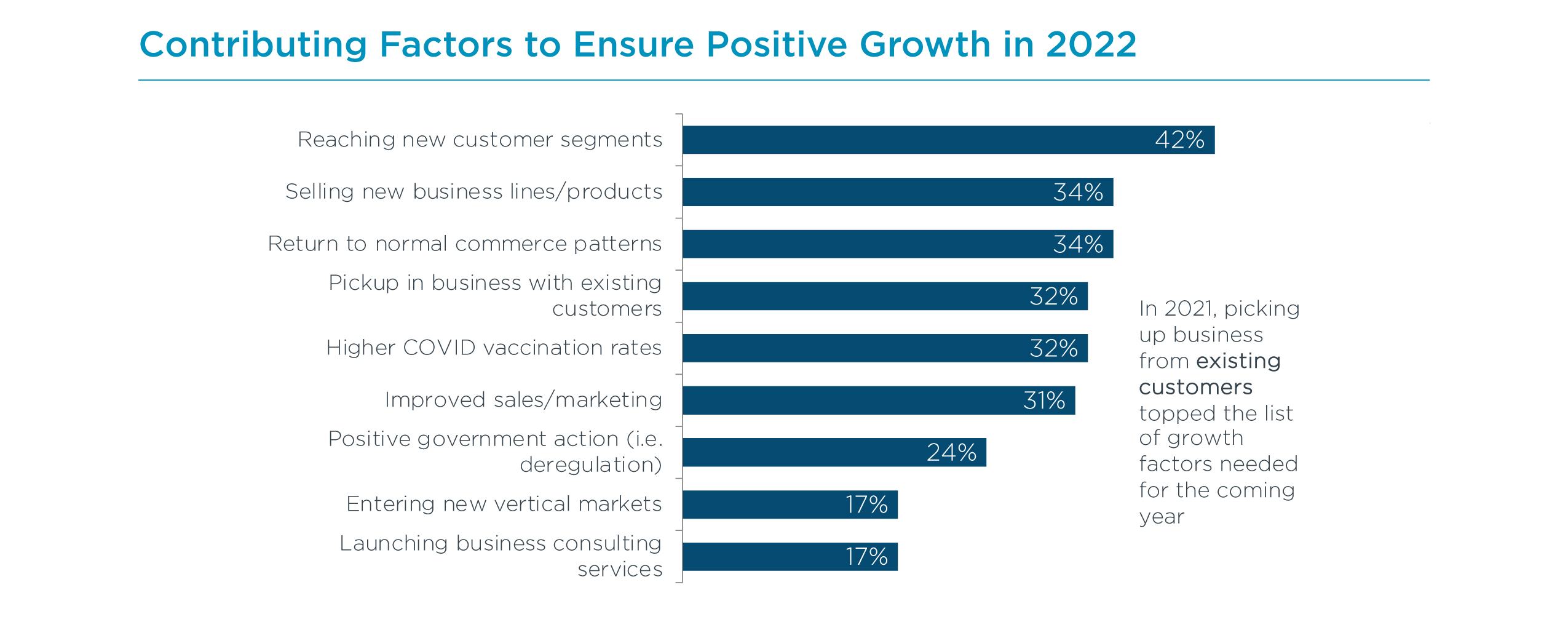

Consider the factors channel firms say will be key to achieving positive growth in 2022 and how they've repositioned from the previous year. In 2021, respondents said growth was predicated on picking up business from existing clients, which made sense in the pandemic-drenched economic climate that made finding new customers challenging and budgets tight. But looking ahead to next year, respondents now say reaching new clients is the No. 1 factor to drive growth. No one's forgetting their current customers, of course, but the hunt is on for new ones to fill the pipeline.

Also indicative of a more hopeful stance to the new year, one third of respondents pointed to the ability to sell new business lines and/or products and services as key to growth. This could mean expansion into some of the emerging technology disciplines, specializing in a new vertical or doubling down on a services-based business heavy on consulting, to name just a few directions channel firms might venture to spur growth.

Firms are also counting on a return to normal commerce patterns. One third of respondents say this is necessary, and they are most likely referring to the delivery and forecasting bottlenecks that have resulted from the last two years of pandemic-related supply chain disruptions. Channel firms know that landing new customers is great, but a short-lived win if you end up disappointing them on delivery timing and logistics. Poor customer experience just throws cold water on the entire relationship. And today, more than ever, providing A+ customer experience ranks high in the return to strategy.

Other areas respondents are looking for as growth drivers: more business from existing customers; higher COVID vaccination rates, presumably among staff, customers and suppliers; and improvements to sales and marketing acumen/efforts.

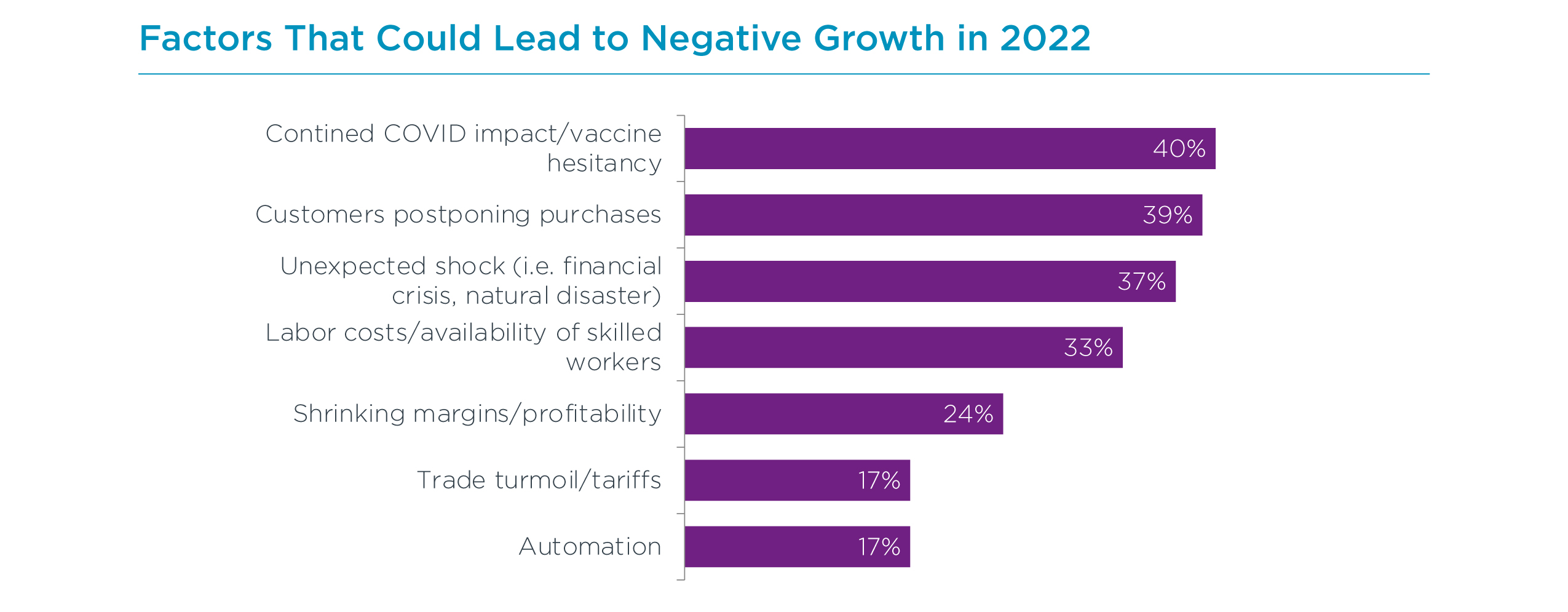

What could derail 2022? A year ago, it was the continued effects of COVID-19 and whether that would result in sluggish customer demand and postponed purchasing. This year is no different: Respondents still worry about COVID's long tail and vaccine hesitancy, as well as customers pumping the brakes on purchasing. In keeping with this theme, they also are concerned that some other unexpected macroeconomic shock to the economy—such as a weather-related disaster or financial crash—could derail growth plans.

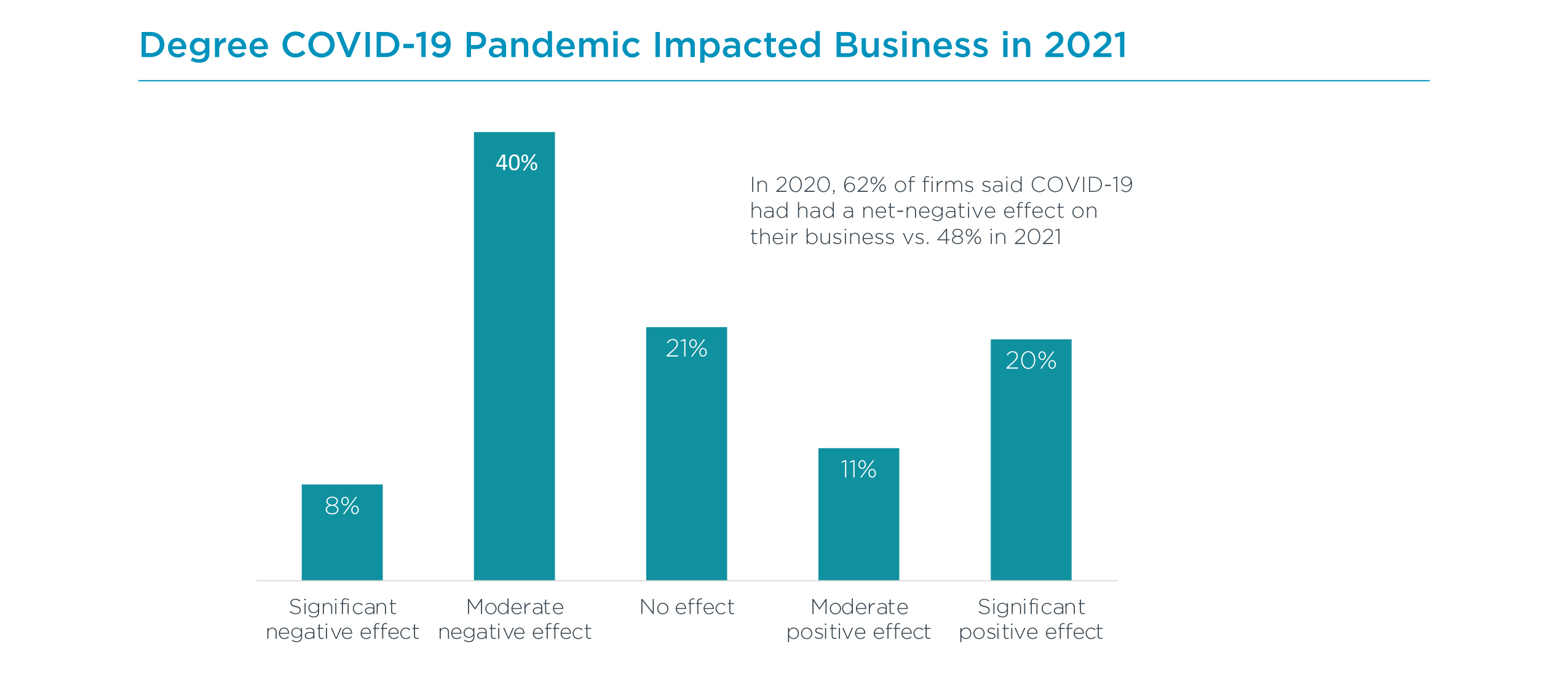

The effect COVID has had on businesses in the channel is undeniable, with one third of companies reporting some downside impact in the past year. And yet, that's improvement; in 2020, half of respondents said COVID affected them negatively. For those companies that reported some positive impact of COVID, there was also an increase year over year. In 2020, 25% of channel firms said their business benefitted in some way during the pandemic; that percentage bumped up to 31% in 2021. Some of this upside came from the continued opportunity to assist customers with the mass move to and management of remote work, which included a wide variety of activities from device sales and implementation to cybersecurity consulting and oversight. Additionally, a segment of customers accelerated their digital transformation efforts during the pandemic, using outside firms from the channel to assist them in the journey.

Looking ahead to 2022, one third of companies are expecting a net-positive effect of the lingering pandemic, while 27% are still cautiously concerned about a net-negative impact. Another 31% are putting the pandemic in the rearview window businesswise, predicting no impact up or down in the coming year. It's clear that as customers begin to recover from the pandemic's torrent, they will be building back technology budgets, reigniting projects that had been stalled, and looking for ways to better prepare for any future crises of the same type. Well-positioned channel firms should seek to be involved in many of these turnaround activities.

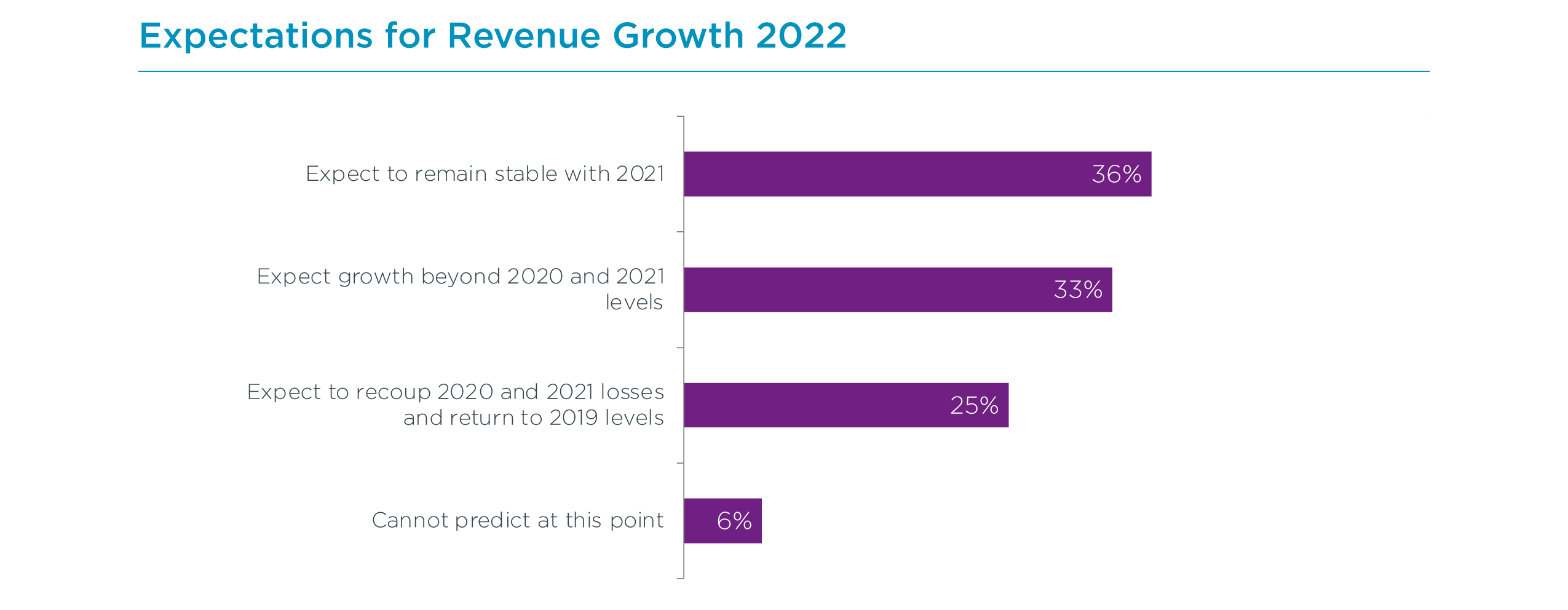

From a revenue perspective, things are looking solid. The optimistic majority (58%) expect that they will either grow revenue in 2022 in excess of both 2021 and 2020 results or will recoup any losses from 2020 and 2021 to return to 2019 revenue levels or beyond. Another 36% expect to remain stable with 2021, though that could be a revenue level that was less than 2019 for those firms. When we talk about a return to strategy, revenue growth expectations are a major indicator of a company's ability to execute. For 2022, execution means pivoting to a services-based business, getting serious about emerging tech opportunities, and doubling down in a more sophisticated way with cybersecurity efforts and offerings.

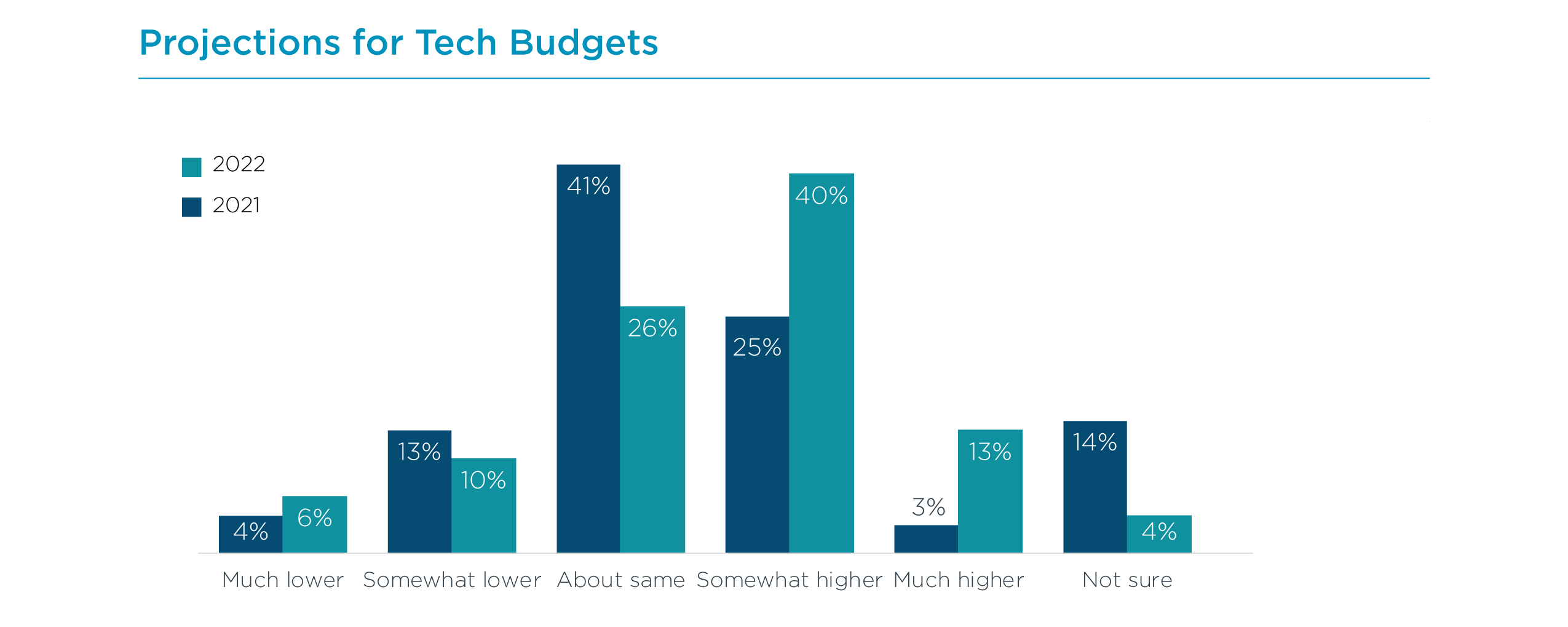

Of all the indicators of a return to strategy by channel firms, budget forecasts for 2022 are the most demonstrable—especially when compared with projections made a year ago. Looking ahead to next year, a majority (53%) of channel companies expect to have higher tech budgets, while only 28% did so in the same timeframe last year. Even the number of companies that expect the same budget allocation in 2022 as 2021 declined significantly from 41% to 26%.

More money in the coffers typically means more spending. This positive development most likely signals a return to initiatives such as entering new markets, branching into new services and skills, hiring and recruiting, and investing more in sales and marketing.

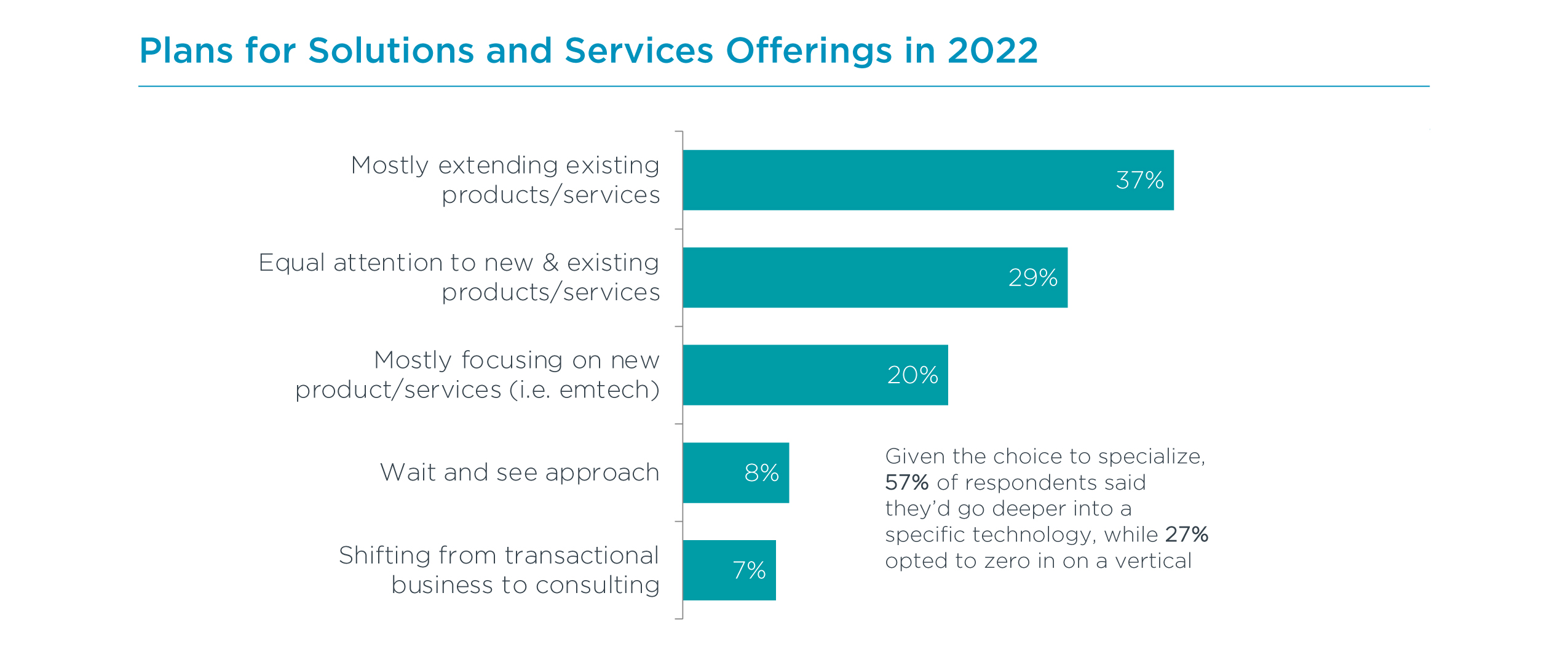

In addition to new areas of focus, channel firms in 2022 are committing to extending and growing their existing portfolios. Nearly four in ten are pushing ahead with their current offerings. It's likely they've held back during the last year or two in growing those business lines or introducing them to new audiences. With more budget at their disposal and greater optimism in general, companies are now freer to polish up their core business for the future. New services and solutions factor in as well, however. Nearly half (49%) of respondents said they are either mostly focusing on new areas such as emerging technologies or paying equal attention to both new and existing lines of business. This reflects a smart balance, especially in a time of continued uncertainty, even if it's tinged with more hopefulness than a year ago.

That said, companies are quite bullish on their expectations for revenue growth over the next two years for their existing products and services offerings (See Appendix). Three quarters of respondents predict moderate to significant growth in these areas, while just 7% forecast a decline in sales. Among the largest channel firms (100+ employees), a full third expect significant growth from their solutions and services sales in the coming two years. Many of these firms have felt a pinch because of supply chain issues during the pandemic and reticent customers spending. As those negatives start to wane, business activity should accelerate.

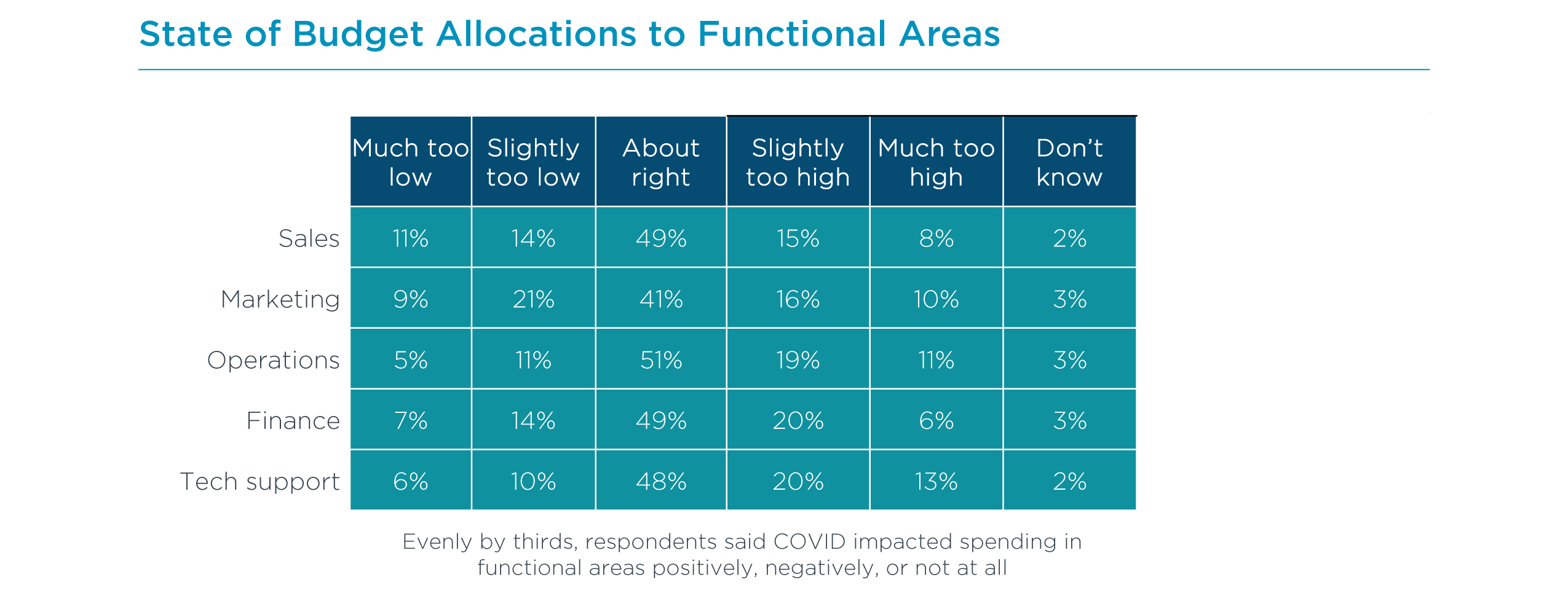

Respondents have some clear opinions on what department areas are getting sufficient allocation in their overall budget versus those areas that could use either more or less in 2022. While roughly half of respondents believe funding is where it should be across all five functional areas surveyed (sales, marketing, operations, finance, tech support), sales and marketing rate highest as areas being slightly shortchanged. Marketing is an obvious one for this distinction. For many channel firms, this activity has always lagged in both resource allocations and general attention. Few channel firms employ a full-time marketing staffer and the discipline itself has often been overlooked, but on the bright side, data of the last several years shows a more concerted effort around marketing, messaging and branding. Baby steps.

Last year, a whopping 31% of channel firms feel that the budget for tech support within their organization was too low—ironic seeing as tech support is a core mission for most channel firms. This could have been due to the unforeseen deluge of tech support calls from customers whose workforces went remote overnight. This year, respondents are looking much happier with what their firms are allocating for tech support, with just 16% now saying it's too low. Channel firms may have gotten the message that remote work is here to stay and therefore spent to increase capacity to meet demand.

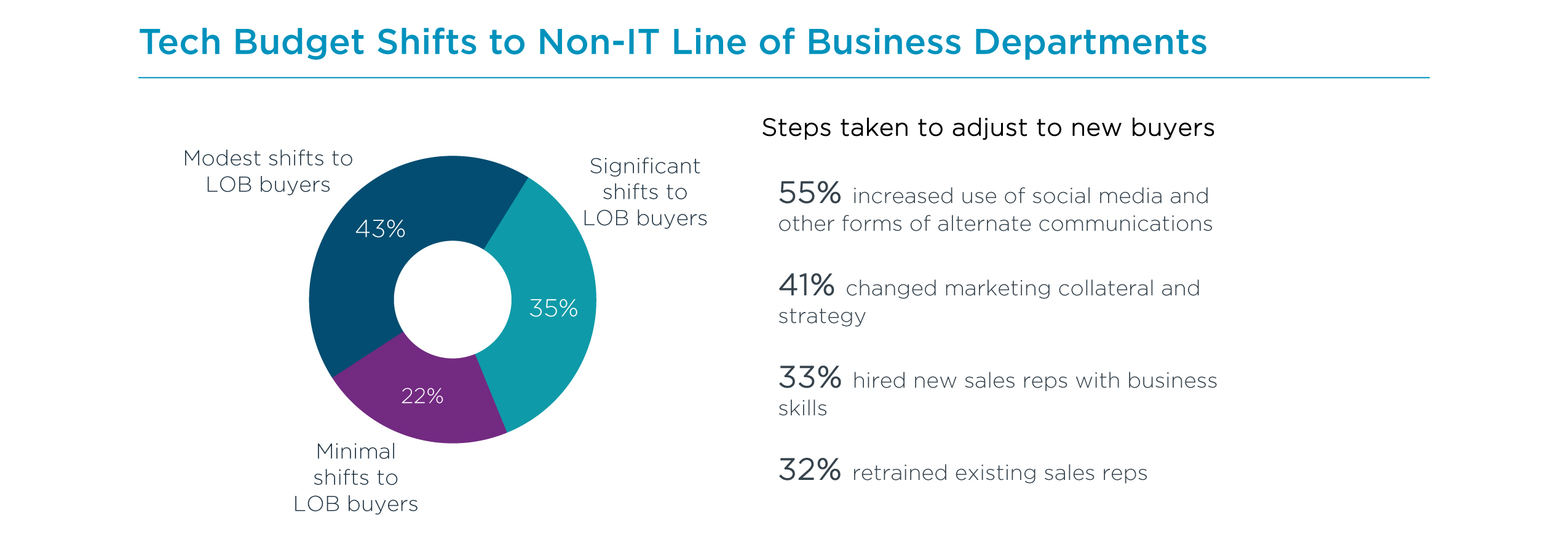

Understanding the customer—who they are, what they prefer/need, how they buy—is a crucial ingredient for channel success in the new year. For years now, the industry has seen a slow but steady shift in who holds the purse strings when it comes to technology decision making and procurement. More and more line of business executives today possess tech budget and routinely make critical purchasing decisions for their departments and staff—both with and without the involvement of an internal IT department. This has necessitated change within channel firms seeking to work with these customers, especially with respect to sales techniques and activities, as well as marketing messaging and the choice of conduits for communication.

More than one third of respondents report significant shifts to LOB buyers in their customer dealings, with another 43% experiencing a modest shift. That's not anything to ignore. These are buyers who will expect a business conversation from their sales reps. They want a channel provider that has unique knowledge of their business's main mission, operational idiosyncrasies and ultimate goals. And then they expect their partner to know how to apply the right technology, demonstrate consulting acumen, or provide ongoing services work to account for each of those objectives. The shift in conversation can be daunting for some used to selling speeds and feeds to a tech professional, but the skill will be essential moving forward as part of overall improvements to customer experience.

Consider the following from CompTIA's research study, Customer Experience Trends in the Channel. The top three items cited as critical to the future health of the channel were:

- Providing a desirable customer experience as a competitive differentiator

- Recognizing shifting customer dynamics and selling consultatively

- Increasing investments in marketing

It seems many in the channel are taking heed of that advice. More than half (55%) are appealing to new types of buyers by increased use of social media for marketing, sales and communications; 41% have changed their existing marketing collateral and overall strategy; and one third have hired new sales reps that crackle with business skills and the vernacular to appeal to LOB executives.

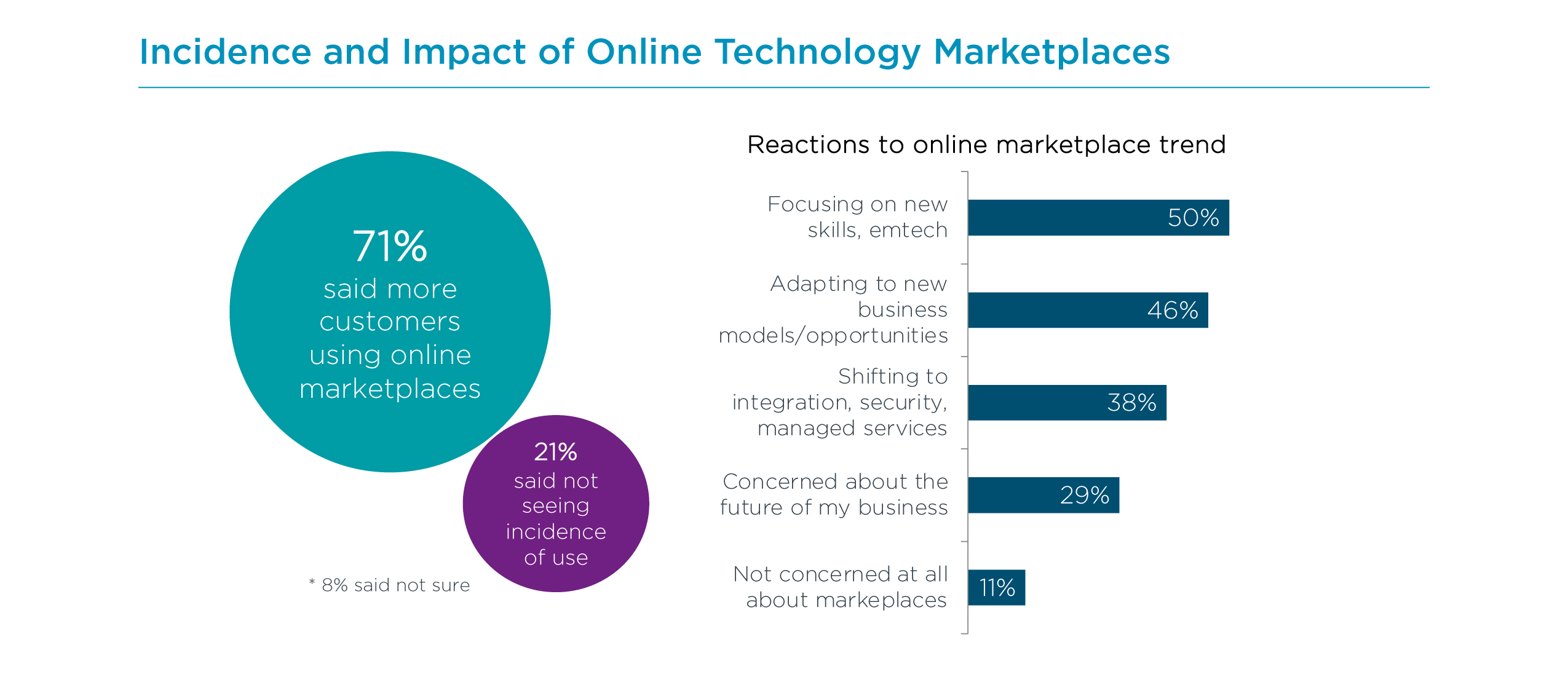

It's wise that channel firms are moving in this direction, in part because there is an elephant in the room they must acknowledge: online marketplaces. Today, online marketplaces, such as those from Amazon and Google to Microsoft and Salesforce, have become the direct, go-to option for many tech purchases in today's cloud era. Everything from hardware devices to SaaS applications and beyond is available at the click of button for customers today. This could deflate channel firms that now feel displaced from the sale, but marketplaces don't necessarily have to do so. A synergy exists for those channel firms that adjust in their business model to be more consultative and specialized, while emphasizing the after-market services that customers will very much need after initial tech purchase.

Strategic adjustment is key because marketplaces are a trend that's not going away. Nearly three quarters (71%) of channel firms acknowledged that more customers today are using marketplaces for their initial purchases. To deny the impact of marketplaces would be folly. Savvy channel firms instead are brushing up on new skills, especially in the emerging tech areas, so they can be a go-to advisor to customers as they dip their toes in this unfamiliar territory. Other moves include being more flexible to new opportunities and business models. A transactional model today might no longer be tenable and better replaced by a managed services type business approach, for example.

It should also be noted that customers aren't the only group that can avail itself of the easy-to-buy environment of an online marketplace; channel firms can as well. Whether procuring products and applications from the marketplaces to then sell to customers or directing clients to the right item sold on Amazon to fit their needs, there is opportunity for a relationship to exist between the two entities.

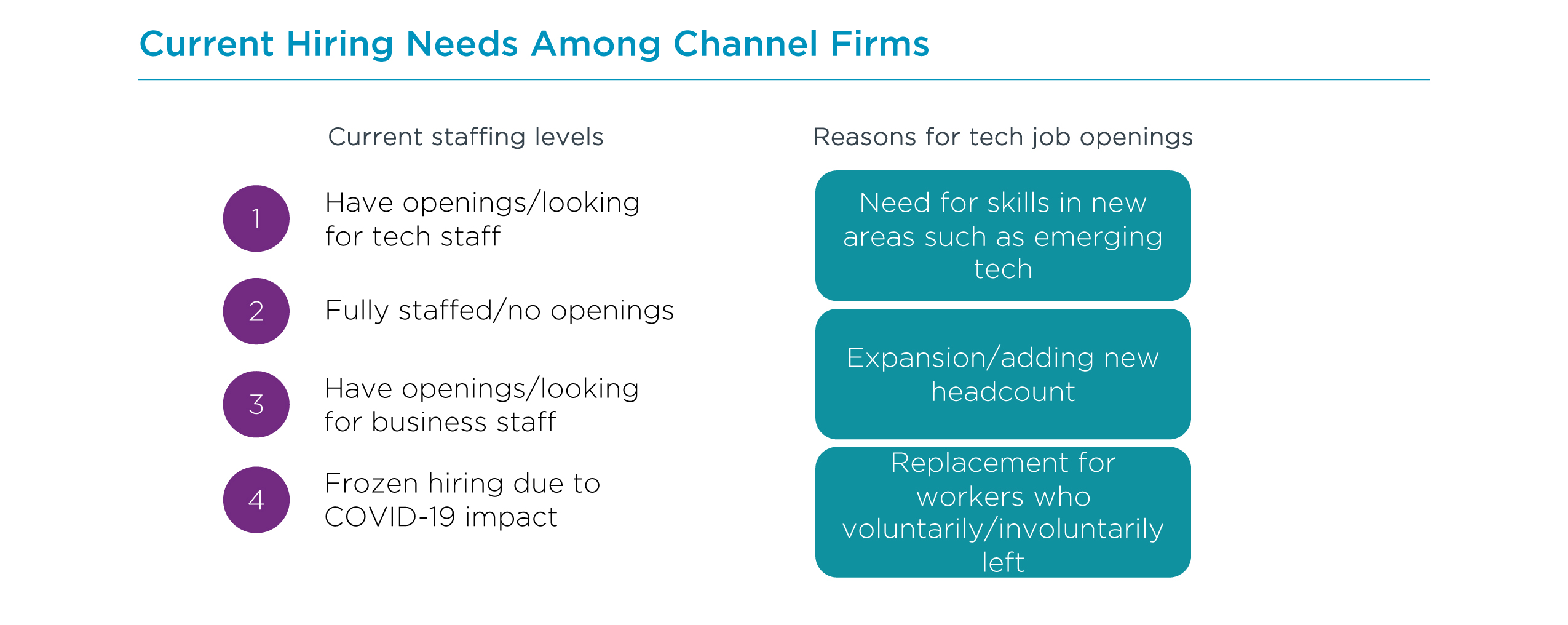

Along with considerations around revenue, budgeting and customer dynamics, the human resources factor each channel company faces can't be ignored. Staffing, open positions, skills gaps, retention, diversity—each area presents a challenging moment for employers. Despite current pandemic conditions, many channel firms are nonetheless on the hunt for new employees, particularly those with skills in certain areas such as emerging tech (IoT, AI, etc.), as well as business acumen for sales and marketing positions. More than a third (35%) of firms report having current openings they are actively looking to fill in technology roles. Another 24% are angling to shore up their business-related employee base, an increase from 15% last year. Thirty-two percent are fully staffed at present, while 7% said they remain in a hiring freeze directly related to COVID-19's impact. In 2021, 13% were in a hiring freeze due to COVID.

The business model, technology focus and type of customers served will greatly influence the staffing needs of the typical channel firm. For example, a managed services provider may well need more tech staffing now that a majority of its customers are working from home instead of a central office location. Other companies are grappling to fill staffing holes because some of their employees needed to leave the workforce to tend to school-age children at home during the pandemic. Other channel firms are using their solid financial base and positive cash flow to dive into new markets and grow during this uncertain time. For other firms, it's about strategic thinking and finding people with skills to tackle the nuances of the emerging tech landscape.

Emerging tech skills are in high demand among channel firms, and often hard to find. But other obstacles have complicated hiring as well, including rising salary expectations and competition for talent from other tech providers. Increasingly, other industries outside of tech are in the mix for potential job candidates. And while last year's approach to hiring issues was foremost to retrain existing staff for open positions or to address new areas of focus, this year channel firms turned to contract (1099) workers to fill open positions. This might reflect a reality of COVID-era employment shifts and the gig economy generally, or contract hiring could be seen as a way to combat salary demands of full-time hires. For those hiring externally, recruitment efforts that seek out more diverse applicants is underway. Others have eliminated the four-year college degree requirement altogether.

Appendix

About CompTIA

The Computing Technology Industry Association (CompTIA) is a leading voice and advocate for the $5.3 trillion global information technology ecosystem and more than 50 million industry and tech professionals who design, implement, manage and safeguard the technology that powers the world's economy. Through education, training, certifications, philanthropy, and market research, CompTIA is the hub for advancing the tech industry and its workforce.

About this Report

CompTIA's IT Industry Outlook 2022 provides insight into the trends shaping the industry, its workforce and its business models. Because trends do not occur in a vacuum, the report provides context through market sizing, workforce dynamics, and other references to supporting data. The interrelated nature of technology—where elements of infrastructure, software, data and services come together—means trends tend to unfold in a step-like manner. A breakthrough may lead to a notable advance, which may then be followed by what could be perceived as lateral movement as the other inputs catch-up. Some of the trends highlighted in this report focus on an early-stage facet of a trend, while others recognize a trend moving beyond buzzword to reach a certain stage of market-ready maturity. As such, the timing of trend impact may vary from reader to reader depending on company type, job role or country. Lastly, this report is not meant to cover every trend in the industry. Other trends are covered in additional CompTIA research. Visit www.CompTIA.org for past versions of the IT Industry Outlook and an extensive library of research and educational content.

Read more about IT Workforce.

Marketing Strategy For Software Development Companies

Source: https://www.comptia.org/content/research/it-industry-trends-analysis

Posted by: desmondbaccough.blogspot.com

0 Response to "Marketing Strategy For Software Development Companies"

Post a Comment